Jun 5, 2020

Hertz's possibly worthless equity soars amid recovery optimism

, Bloomberg News

Lorne Steinberg discusses Hertz

Hertz Global Holdings Inc. shares are rallying two weeks after the company filed for bankruptcy in an extreme example of the bets investors are making on recovery from the coronavirus pandemic.

The car renter’s stock traded as high as US$2.92 before the start of regular trading Friday, a 258 per cent surge from Wednesday’s close.

Hertz and its rival Avis Budget Group Inc. got a boost Thursday from signs air travel is poised to rebound.

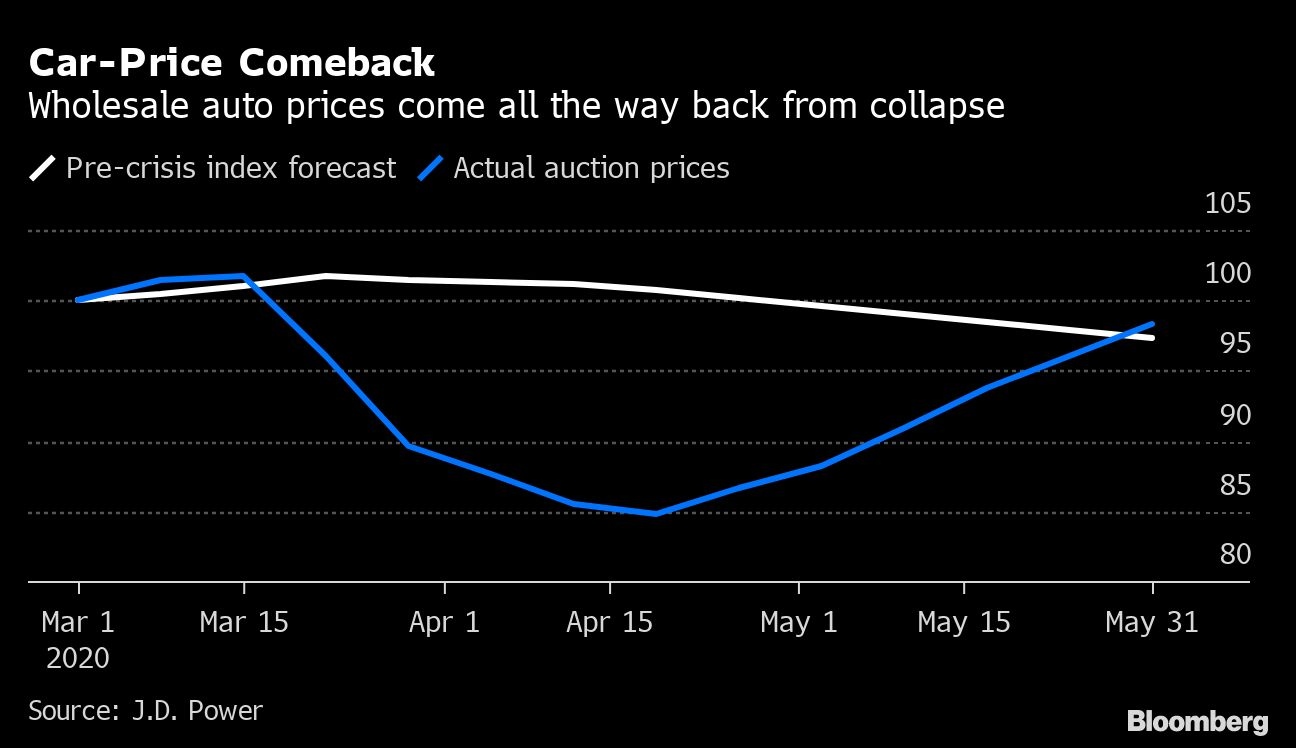

Hertz also is likely to benefit from prices of used cars at auctions coming all the way back from a mid-April collapse.

Market researcher J.D. Power said Thursday that prices last week were above its pre-virus forecast.

Those positives aside, Hertz’s equity holders are still taking on significant risk.

Shareholders rarely recover anything from companies that have filed for Chapter 11 because under U.S. Bankruptcy Code, all of a company’s debts must be repaid in full before stockholders recover anything.