Sep 22, 2021

History Shows Stock Market Disregards Debt Limit, Shutdown Talk

, Bloomberg News

(Bloomberg) -- Stock investors tend to ignore debates over the U.S. debt limit and a potential government shutdown, content that Congress will eventually pass essential legislation. While analysts at Goldman Sachs Group Inc. expect a repeat in the next month, they warn that shares of companies most-dependent on government revenue could suffer.

Democrats, who have slim majorities in the House and Senate, have proposed legislation that links a suspension of the debt limit to a so-called continuing resolution to allow the government to keep spending past the Sept. 30 end of the fiscal year. Republicans are offering little support, raising alarms from Treasury Secretary Janet Yellen that delaying a debt limit resolution could cause a disastrous default.

Alec Phillips at Goldman doesn’t expect a government shutdown next month, writing in a note Monday “there is a fair chance that Democrats will shift strategy before the deadline.” In a separate note, Goldman strategists led by David Kostin said that the S&P 500 likely will be unaffected by the political fracas, as has happened in past showdowns over the debt limit or government shutdowns.

Except for one group of companies -- those that get 20% or more of their revenue from the government. A basket of 83 such firms, including Lockheed Martin, Humana Inc. and Booz Allen Hamilton Holding, “underperformed the mid-cap S&P 400 around the 2011 and 2013 debt limit deadlines.”

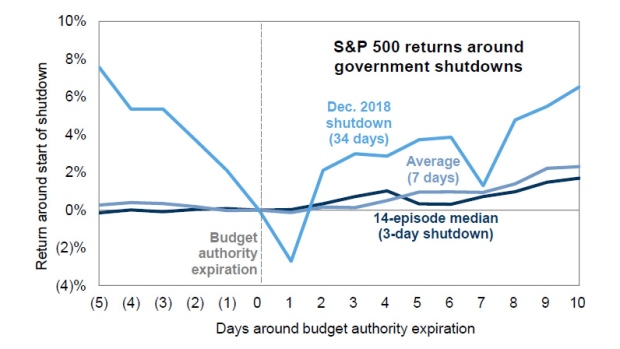

Otherwise, stock-market performance around 14 government shutdowns since 1980, as well as debt-limit fiascoes in 2011 and 2013, “shows no major consistent reaction of the S&P 500 to these fiscal catalysts,” wrote Kostin’s team. The typical shutdown over that period has lasted just three days, they said, though the most-recent four have averaged 18 days.

“History shows that U.S. government shutdowns generally have not meaningfully impacted equity returns,” they said. “Rather, the underlying macro environment has been more important for equity performance.”

Read more: Why U.S. Is Having Yet Another Debt Ceiling Debate: QuickTake

Gina Martin Adams at Bloomberg Intelligence also argues stocks are unlikely to be overly affected if the U.S. government partly shuts down at the start of October. Though she accepts a mini-shutdown could happen, she points out that the S&P 500 rose during the one that occurred in the winter of 2018.

“A U.S. government shutdown may offer another convenient excuse to avoid riskier assets in the short run, but history suggests it shouldn’t be an enduring negative for stocks,” she wrote in a note with Nathan Dean.

Meanwhile, for Emily Roland, co-chief investment strategist at John Hancock Investment Management, any volatility could be seen as an opportunity.

“That Washington element can tend to be focused on too much -- in fact, if it causes any kind of risk in the market, we would look opportunistically to add positions,” Roland said in an interview with Bloomberg TV.

©2021 Bloomberg L.P.