Oct 20, 2023

How a Vegas Whale, and Many More, Tap Billions Meant for US Housing

, Bloomberg News

(Bloomberg) -- As prices across the US climbed last year, Texas tycoon and legendary high-stakes poker player Andy Beal saw a chance to profit. All he needed was several billion dollars to wager on inflation.

Two banks he owns got the money, leaning hard on an unexpected source. They pulled $4.4 billion from a government system created during the Great Depression to help Americans get mortgages, regulatory filings show.

Beal is just one of many financiers tapping into the nation’s 11 Federal Home Loan Banks, often for reasons completely divorced from housing. It’s not illegal. But they represent what critics say are gaping, unaddressed problems with the $1.4 trillion system.

There are now numerous banks and insurance companies using decades-old memberships with the FHLBs to manage their balance sheets, even though they’ve retreated from mortgage lending. The home-loan banks also propped up several mid-size lenders — including Signature Bank, Silicon Valley Bank and First Republic Bank — that failed this year after catering to crypto firms, venture capitalists and the ultra-wealthy.

What’s more, wave after wave of savvy bankers and investors have exploited loopholes over the past decade to gain access to the FHLBs and their cheap money. While many of these were at least involved in mortgage lending, some have operated more like hedge funds or made loans to celebrities including Johnny Depp.

As millions of Americans struggle to buy homes, the connection between the home-loan banks and home lending has drawn more scrutiny from lawmakers and regulators.

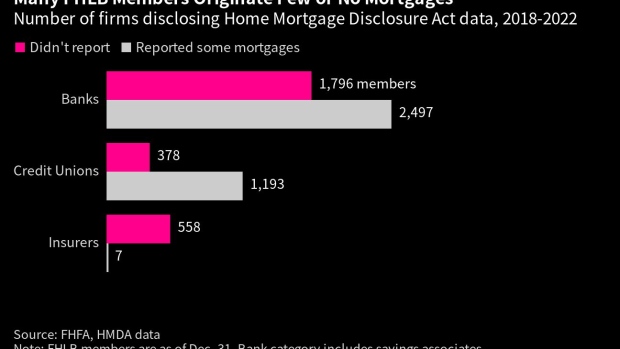

By the end of last year, 42% of the more than 6,400 banks, credit unions and insurers that could borrow from the system hadn’t reported making a single mortgage in the past five years, according to a Bloomberg News analysis of millions of home-lending records submitted to the government.

The reasons are varied, but many members lend so little to homebuyers that they aren’t subject to the reporting requirements of the Home Mortgage Disclosure Act. Even then, some firms may play an indirect role in the market, buying mortgage-backed securities or loans originated elsewhere.

The data illustrate how the US has failed to adapt its rules for the home-loan banks to keep up with dramatic changes in the mortgage market. The FHLBs operate under a vague congressional mandate to “promote economical housing finance” by making loans to a broad range of financial firms. That has left ample room for interpretation and is prompting calls to tighten the rules.

“Is the membership broader than it needs to be, and does it facilitate lots of activity with little social benefit?” said Mark Calabria, who led the Federal Housing Finance Agency, which regulates the home-loan banks, from 2019 to 2021. “It does, and that’s a problem.”

The agency has spent the past year reviewing FHLBs to propose ways to update the system. Officials have considered potentially capping how much giant financial institutions can borrow, and allowing nonbank mortgage lenders to become members, people familiar with the matter have said. But even then, lawmakers and regulators would have to follow through with new rules amid deep divisions in Congress. The FHFA declined to comment ahead of its report.

Cheap Cash

The FHLB system began nine decades ago as lenders struggled to find funding during the Great Depression. The concept was simple: Mortgage providers could bring home loans to regional FHLBs, post the debts as collateral and get more cash “advances” to keep lending.

To ensure FHLBs have money to dole out cheaply, they enjoy a variety of tax breaks and an implicit government guarantee. But the market they serve keeps changing. Insurers and savings associations used to be big home lenders but aren’t anymore. Many banks retreated after the 2008 financial crisis. Today, four of the five biggest US home lenders are independent mortgage companies — such as Rocket Cos. and UWM Holdings Corp. — that can’t join FHLBs.

Yet, as Bloomberg has reported, members love the cheap and easy-to-get funding, pushing advances to a record earlier this year. They get the money with a variety of collateral, such as Treasuries, and can use it for just about anything. And once they become members, they typically stay members, even if they stop making mortgages.

What makes FHLB financing so attractive is that the interest rates can be lower than what many members can get elsewhere, especially on short notice. At the end of 2021, the weighted average rate charged by home loan banks was close to 1%. Even after the Fed embarked on a spree of hikes, the money cost members 4.4% on average at the end of June. Advances can last anywhere from a day to 30 years.

Read More: A $1.5 Trillion Program for Homebuyers Props Up Banks Instead

Not surprisingly, other firms want in on that.

Over the years, investors have developed a number of strategies to become members. Some founded so-called captive insurance companies with no clients but themselves. More recently, entrepreneurs have set up mortgage lenders that qualify for FHLB access by pledging to serve poor and minority communities. But regulators have since grown concerned about the accuracy of some applicants’ statements.

What’s important, the FHLBs argue, is that most of the money they dole out is backed by loans to finance housing. In 2021, almost 60% of the collateral for advances was composed of primary mortgages on single-family residences and loans for apartment buildings, according to a report FHFA compiled for Congress last year. Even more was tied to bundles of residential mortgages packaged into securities.

“However the advances are used, the connection to housing finance begins with collateral they pledge,” said Ryan Donovan, chief executive officer of the Council of Federal Home Loan Banks, a trade group. Ultimately, the home-loan banks are just following rules Congress set. Members can only be certain kinds of financial institutions, he added, and “they also have to be creditworthy.”

High-Stakes Player

Andy Beal is not a typical banker. A math enthusiast, he formulated a conjecture about Fermat’s Last Theorem and sponsors a $1 million prize for anyone who can prove or disprove it. He started a rocket company. And, in the early 2000s, he participated in some of the highest-stakes Texas Hold ’em hands that had ever been played in Las Vegas, a history chronicled in the book The Professor, the Banker, and the Suicide King: Inside the Richest Poker Game of All Time.

Beal Financial Corp., his Plano, Texas-based holding company, has been referred to as an “FDIC-insured hedge fund,” because its banks use customer deposits backstopped by the Federal Deposit Insurance Corp. to make unconventional investments.

Visiting one of his company’s branches makes for an odd experience. On a recent Friday afternoon, two workers staffed Beal’s outpost in Seattle’s wealthy Bellevue suburb. Though it’s across from city hall and surrounded by office towers, there were no customers. The mood was tranquil, with soft lighting, dark wood and stuffed armchairs. A placard advertised rates for various savings products. There were no mortgages to be had.

The limited offerings are mirrored on the company’s website, which also plugs an outfit called CLG Hedge Fund that isn’t a hedge fund. It’s Beal’s affiliated commercial real estate lender. Beal told Bloomberg Markets magazine in 2011 that he named it that because he wanted his employees to think like hedge fund managers, focusing on the most lucrative loans.

Beal, 70, sometimes waits years to pounce on lending opportunities. During California blackouts in 2001 he snatched up the distressed debt of power plants. When the Sept. 11 terrorist attacks wreaked havoc on the airline industry, he bought bonds secured by commercial aircraft. He eschewed subprime mortgage lending before the 2008 housing collapse, later scooping up debt at discounts.

By the end of 2021, his company’s assets hovered around $7.4 billion, a Federal Reserve filing shows. Over the course of last year, the company quadrupled in size, scooping up government debt. MarketWatch reported in April that almost all of the buying spree focused on Treasury Inflation Protected Securities, or TIPS. Regulatory filings from Beal’s banks show two main sources of new funding around that time: a flood of deposits and the FHLB system.

The surge in FHLB advances was so large that the Federal Home Loan Bank of Dallas called it out in its own securities filings, noting in August 2022 that some of its new outsize lending was being used “to fund investment activities.”

While TIPS can protect against runaway inflation, there’s a catch: Their value can fall as the Fed raises interest rates. And that’s what happened. An index of shorter-dated TIPS, like the ones Beal reportedly bought, has had a negative 1.4% return since the Fed began hiking rates. Beal’s own banks marked down their Treasury securities by 4.5%, or almost $1 billion, as of June 30.

Meanwhile, his banks’ outstanding loans for residential real estate have declined since the firm started running up its tab at the FHLB, falling 32% to $368 million, or just 1% of assets, filings show.

Beal declined to comment through a spokesperson. A representative for the Dallas FHLB said it wouldn’t comment on a specific member.

Beal’s FHLB borrowings show “he is just making rational, profit-maximizing use” of an available source of money, said Sherrill Shaffer, emeritus professor of financial services at the University of Wyoming. But Shaffer said the move also raised an important question: Should government-supported institutions “be involved in funding individual predictions about macroeconomic conditions?”

A Member’s Collapse

Such skepticism arose repeatedly this year when regional banks ran into trouble. One of them, Silvergate Bank, had turbocharged its growth by creating a payments system for the cryptocurrency industry. When digital assets slumped last year, its depositors fled. As it tried to keep up with those withdrawals, Silvergate leaned on the Federal Home Loan Bank of San Francisco, taking out $4.3 billion in advances at the end of last year, equivalent to almost 40% of the firm’s assets.

The bank was entitled to the money. It had been an FHLB member for almost three decades, operated a wholesale real estate lending arm and had eligible collateral. But the bank’s leaders came to regret the decision to take the funds because of the negative attention it attracted, according to a person with knowledge of the matter who asked not to be named discussing private talks. In late January, Democratic Senator Elizabeth Warren of Massachusetts and two other lawmakers pressed CEO Alan Lane in a letter asking whether the bank’s advances would be used to make home loans.

Within six weeks, Silvergate announced it repaid the FHLB and was voluntarily closing. Representatives for the company didn’t respond to requests for comment.

The episode shows how the FHLB system acts as a shock absorber to the industry, providing quick, “on-demand liquidity” to members, said Teresa Bazemore, the San Francisco FHLB’s president. That wouldn’t work if FHLBs stopped to make judgment calls about how advances are used, she said.

Whether the home-loan banks should be playing such a role is a hotly contested issue. Former Fed Governor Daniel Tarullo argued last year that the system has had trouble borrowing in the bond market at times of acute financial stress and can be an unsustainable crutch for some of its members. Worse, he added, the system’s reliance on short-term debt undermines the work of other regulators to make the financial system safer.

Finding Loopholes

Firms on the fringes of the mortgage market have long sought access to the home-loan banks and their cheap money. After the 2008 financial crisis ushered in new laws, investors hatched a strategy to gain membership by starting insurance companies. But the insurers were shells — they didn’t have clients other than the parent companies that launched them.

Ladder Capital Corp. was the first to land on the idea of joining the home-loan banks. In 2012, a newly created subsidiary — Tuebor Captive Insurance Co. — became a member of the FHLB of Indianapolis. Other investment firms that bet on real estate debt, including Annaly Capital Management Inc., Invesco Mortgage Capital Inc. and Two Harbors Investment Corp., also had insurers that joined the system.

Regulators proposed blocking the practice in 2014, but the Indianapolis FHLB continued signing them up. The new members were big business. Three captive insurers alone borrowed $2.5 billion, or 13% of its outstanding advances, as of Sept. 30 that year, a securities filing shows.

“FHLBank Indianapolis has at all times been and remains in regulatory compliance with membership rules,” said John Bingham, a spokesperson for the institution. Representatives for Ladder, Annaly, Invesco and Two Harbors didn’t respond to requests for comment.

The FHFA finally closed the loophole in 2016, requiring that insurers provide coverage to third-parties to be members. But the regulator gave the disqualified members five years to wind down their borrowing, essentially subsidizing the businesses until 2021.

The last of the captives were still borrowing from the FHLBs when mortgage bankers found a new way to gain membership. It involved a little-known designation bestowed by the Treasury Department to financial institutions committed to serving poor and minority communities.

Supporting Do-Gooders

Many Americans have never heard of Community Development Financial Institutions, but among those who have, chances are they’re grateful. The organizations focus on helping people neglected by banks — making homeownership possible in minority communities, struggling urban neighborhoods and depressed rural areas.

Read More: Flawed US Home-Loan System Forsakes the Buyers Who Need It Most

To support that mission, the government exempted CDFIs from the strict documentation requirements banks face, opening the way for them to make “nonqualified mortgages” to borrowers who otherwise might not get loans. It also let them tap cheap FHLB financing, so long as they proved themselves financially sound. The more perks they got, the more investors became interested in the program.

Several years ago, sophisticated financial firms including Fortress Investment Group and Bayview Asset Management began setting up CDFIs. California financier Steven Sugarman joined the rush in 2017 just months after he resigned as CEO of Banc of California. He founded what came to be known as The Change Co.

Sugarman’s company described its aspirations in a press release that November, vowing to get CDFI certification and become a member of the FHLB of San Francisco to serve “diverse homeowners.”

Change is now a major force in the mortgage market, ranking as the nation’s biggest producer of nonqualified loans, according to industry publication Scotsman Guide. The firm packages the debts into securities and sells them to investors, noting on its website that it makes no representations about the race, ethnicity or income of the underlying borrowers.

Mortgage records show the firm does lend to members of minority groups. But Change is also active in some of California’s toniest enclaves, making jumbo loans that included financing a home for actor Depp in the Hollywood Hills, according to property records and people with knowledge of its business who asked not to be identified because they weren’t authorized to speak publicly about the company’s dealings.

To get Change off the ground, Sugarman adeptly navigated regulatory bureaucracy. Change’s application for CDFI certification was still pending at the Treasury Department in 2018 when he traveled to Washington, DC, with a delegation of housing and financial equity advocates and met with then-Comptroller of the Currency Joseph Otting, who was appointed later that year to serve as the FHFA’s acting head. Sugarman also met separately with senior advisers to then-Treasury Secretary Steven Mnuchin, including the official overseeing the department’s operations focusing on community economic development, according to two people with knowledge of the matter, who asked not to be named discussing private meetings. By the end of the year, Change was not only a certified CDFI, it was an FHLB member.

“It’s ordinary course to meet with CDFI staff before seeking a certification and to meet with them throughout the process to ask and answer questions,” said Graham Miller, a spokesperson for Change. Sugarman also was general counsel of the National Diversity Coalition at the time, and met with Treasury in that capacity, Miller said.

`Unfair Advantage’

To help it ramp up, Change turned its CDFI status into a blunt pitch to other mortgage professionals. An ad it took out last year in the Scotsman Guide invited brokers to send it applications that lacked income or employment documentation because, as the headline put it, “WE CLOSE THE PRIME LOANS OTHERS TURN AWAY.” The ad went on: “Fewer restrictions. More closed loans. That’s our unfair advantage.”

Change’s spokesperson said the “unfair advantage” is meant to help minorities and low-income borrowers. The ad doesn’t make any reference to such groups.

Change had yet to draw its first FHLB advance when things started unraveling. The system’s main regulator, the FHFA, questioned a number of new memberships, prompting names to drop off the rolls.

The CDFI affiliated with Bayview bowed out after being urged to do so by the agency, two people familiar with the matter said, asking not to be named discussing the confidential talks. Fortress’s dropped off, too. Another CDFI, Detroit Rehabilitation Initiatives, was kicked out in August 2019 for falling short of required levels of profit. DRI Fund, as the business is known, had yet to borrow from the home-loan bank system and was “blindsided” by the decision, said Lisette Smyth, the company’s general counsel.

When the San Francisco FHLB revoked Change’s membership it led to litigation, offering a rare look at the government’s concerns. Records filed in court show that the FHLB, prodded by the FHFA, found Change took a novel approach to tallying cash to prove it was sound — lumping in mortgages it planned to sell and more esoteric assets, such as “pair-off and investor receivables.” The firm has argued those were just as good because they could be quickly liquidated and that the FHFA and FHLB were essentially changing practices. The FHLB said that removing the items cut Change’s cash well below acceptable levels for membership.

That raised a question: Why didn’t the FHLB notice the accounting in the first place?

“Arguably, we could have asked for that information upfront,” said Bazemore, who took over in 2021, after the episode. “We are much more focused on verifying everything.”

In August, the Treasury Department went further, stripping Change’s mortgage business of its CDFI status. Change has sued, winning a temporary reprieve in court. Change said it reached an agreement with Treasury officials to extend its CDFI designation.

A Treasury official declined to comment on the reason for its decision, but a document from the regulator filed in the court case shows that officials found that Change failed to meet a key requirement for earning the designation: While it made enough loans to qualified recipients, it hadn’t loaned them enough money.

Chasing Subsidies

Calabria, the former regulator, helped draft the law that let CDFIs join FHLBs when he worked in Congress. He said he knew the rules would be exploited after captive insurers were banned.

“There are some iron laws in Washington,” he said. “If you create a subsidy, people will try to capture it for their own use.”

The question is whether regulators and lawmakers will use the lessons of this year’s bank turmoil to take action. “You’ve now got a window and you can be aggressive,” Calabria said. “But that window will close.”

Note on Methodology:

To examine mortgage lending by FHLB members, Bloomberg News looked at the almost 6,500 financial institutions listed as members by the FHFA as of Dec. 31. The file includes unique identification numbers used by bank, credit union and insurance regulators to identify these institutions. The ID numbers were used to search for any records submitted under HMDA from 2018 through 2022. In some cases, this could not be done directly. For credit unions, Bloomberg translated National Credit Union Administration ID numbers into their corresponding RSSD ID, a unique identifier assigned to institutions by the Fed. These were then used to search the HMDA database. For insurers, Bloomberg used reference files from the National Association of Insurance Commissioners to look up members’ federal tax ID numbers, which were then used to look for available HMDA records. The analysis doesn’t include affiliates of FHLB members that may have separately filed under HMDA. All types of residential loans reported were included in the analysis, regardless of property type or loan purpose.

©2023 Bloomberg L.P.