Jun 2, 2023

How the Value Trade Has Been Smoked by the AI Frenzy

, Bloomberg News

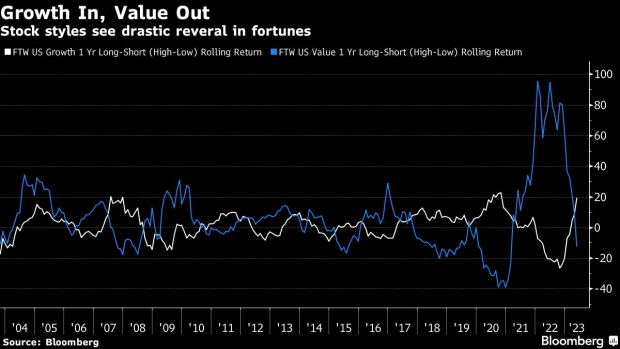

(Bloomberg) -- As fast as it went up for value managers, it’s coming down. The culprit is the all-consuming craze for artificial intelligence.

Proponents of the buy-cheap philosophy have been battered by the relative performance of tech stalwarts, resulting in a mirror image of 2022, when value stocks had their best year versus growth since the dot-com crash. In one example, a Russell 1000 subindex housing the likes of energy producers and banks is trailing a counterpart pegged to growth stocks by the most in more than two decades.

It’s still early, but the reversal, happening at an unprecedented rate, is creating pain among those hoping for a lasting renaissance in the time-tested strategy of value investing. Cheap-looking firms are taking lumps amid financial turmoil and uncertainty about the economy’s future just as AI breathes fresh life into computer and software stocks, an industry that dominates the growth style.

“It was a shorter run than I would have anticipated,” said George Cipolloni, portfolio manager at Penn Mutual Asset Management LLC, referring to value’s leadership. “Now, sentiment is clearly in growth’s favor.”

The S&P 500 advanced for a third week in a row, powered to the brink of a bull market by a handful of tech behemoths such as Nvidia Corp., Alphabet Inc. and Microsoft Corp. The Nasdaq 100 jumped 1.8%, capping a sixth straight weekly gain.

Underneath the surface, value shares lagged behind growth in a seventh week of underperformance. Additional superlatives depicting the stress are piling up.

The Russell 1000 Value Index fell 4% in May, compared with a gain of a similar size for its growth counterpart. That’s the biggest spread in favor of the latter since 2000. Measured by the first five months, the gap widened to 23 percentage points, the biggest divergence in 44 years of data. As a result, value’s outperformance from last year - its first since 2016 — has been almost wiped out.

Again, declaring the reversal permanent is foolhardy after so short an interval. But it’s at least a setback for a cohort of investors who spent most of the 2010s waiting for the market hegemony of megacap technology companies to break. So relentlessly upward was the arc of asset-light stocks such as Meta Platforms Inc. and Alphabet over that period that concern arose that the value style had somehow outlived its usefulness as companies heavy on intellectual property flourished.

To be sure, identical concerns were raised among pundits any time growth beat out value in the past, and — as they were each time then — such theorizing proved wrong when rising inflation and interest rates put the cheap-stock contingent back on top in 2022.

Count Kim Shannon, founder of Sionna Investment Managers Inc., among those unfazed by value’s sudden fall.

“The underperformance for a lot of us value people isn’t that significant,” she said. “We’re just biding our time for a better opportunity to make some hay again.”

With tech behemoths dominating market gains this year, many money managers outside value are also having a hard time keeping up. That’s because the average stock is badly underperforming the broader market. Take the equal-weighted versions of the Russell indexes. The value version that strips out market-cap bias is down 1.7% this year, not much worse than the unweighted Russell 1000’s flat return.

Still, the haste with which value has been knocked down the leaderboard is a blow for investors who had reason to expect their moment in the sun to last longer than a year or so. Thanks to the AI euphoria, 2023 is shaping up as another period when tech megacaps shine at the expense of everything else, supercharging a resurgence in growth.

The reversals have been particularly painful for quantitative investors who amp-up their strategies by constructing long-short portfolios that bet on low-priced stocks while betting against expensive ones.

When growth is the rage and valuations are ignored, the long-short value trade gets punished on both sides with cheaper stocks snubbed while lofty-valued shares get bid up. A Bloomberg index tracking the strategy that strips out industry bias and treats every stock equally is down 11% this year, compared with a 10% rally for the growth factor.

In the eyes of value adherents, the intense focus on growth alone has opened up a rare opportunity for bargain hunters. Take price-to-sales. The bottom quintile of stocks based on the value factor fetches a median multiple of 0.8, a fraction of the ratio of 8.8 garnered by the top quintile. The pair’s relative valuation spread is wider than 91% of the time since 2000, data compiled by Bloomberg Intelligence show. An analysis based on price-to-earnings showed similar results.

“The possibility of a multiyear value run remains intact, with the wide valuation ratios a key driver,” BI’s equity strategists including Chris Cain wrote in a note.

To growth faithful, betting on valuations alone is a fool’s errand. Cheap stocks can get cheaper if profits can’t keep up. Many value shares, such as energy producers and banks, are sensitive to the economic cycle. With the risk of recession looming, the group has an uphill battle.

Then again, anyone positioned for gloom by parking money in cash or bonds is also being left behind by an equity rally that’s lifted the S&P 500 12% year-to-date. The tech-heavy Nasdaq 100 has performed even better, jumping 33%.

For some investors, the prospect of waiting hasn’t been attractive. In the past three months, they pulled more than $15 billion from exchange-traded funds with a focus on the value style, the fastest withdrawals since at least 2016.

“Value tends to have the lowest exposure to many of the megacap growth names and popular themes like AI driving the market,” said Drew Pettit, director of ETF analysis and strategy at Citigroup Inc. “Value factor funds tend to be cyclical. It has been hard to find a bull on anything economic sensitive as recession fears linger.”

The speed with which AI chatter took over Wall Street — coupled with the collapse of a handful of US regional lenders — has made it a tough year for anyone who doesn’t own stocks connected to the theme, according to Phil Hart, a portfolio manager at JPMorgan Asset Management. Still, he’s sticking to his conviction that value will win out — that it’s a game of patience and long-term stamina. But getting to those gains could be a winding road.

“As a value investor, it’s certainly disappointing,” he said. “You’re going to continue to see a bit of a yo-yo market between growth and value, versus more of a permanent trend.”

--With assistance from Emily Graffeo.

©2023 Bloomberg L.P.