Oct 22, 2019

Hungary Keeps Rates Unchanged Before December Policy Review

, Bloomberg News

(Bloomberg) -- Explore what’s moving the global economy in the new season of the Stephanomics podcast. Subscribe via Pocket Cast or iTunes.

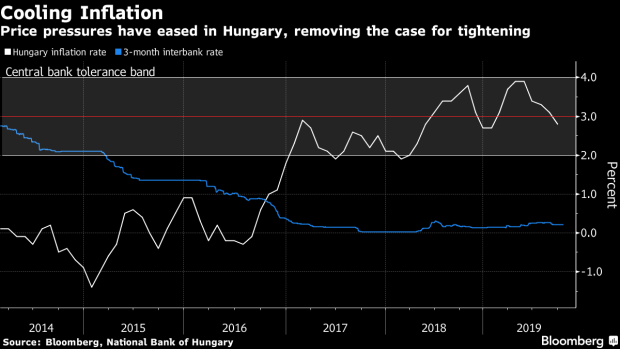

Hungary left its key interest rates unchanged, waiting for further evidence that slower inflation is taking hold before reviewing monetary policy in December.

The central bank, which is only taking meaningful decisions on a quarterly basis, left the overnight deposit rate at -0.05% and the benchmark rate at 0.9% on Tuesday, matching the predictions of all economists in a Bloomberg survey. It will publish a statement at 3 p.m. in Budapest.

The bank has lowered borrowing costs more than anywhere else in eastern Europe, with the dovish turn globally only cementing its stance. Last month, Hungary eased policy slightly in what it called “fine-tuning” as new projections pointed to strengthening downside risks to inflation.

“The central bank’s statement will likely repeat the main message from September,” Orsolya Nyeste, an analyst at Erste Group Bank AG, said before the meeting. “Maintaining supportive financing conditions will remain important.”

Headwinds for the global economy are offsetting a tight labor market and strong consumption at home, pushing inflation below the 3% target in September. Consumer-price growth is “adequate,” central bank Deputy Governor Marton Nagy said last week.

Nevertheless, the market is signaling a greater chance of interest rates rising than falling in the coming year. Forward-rate agreements indicated 13 basis points of increases in the next 12 months.

To contact the reporter on this story: Marton Eder in Budapest at meder4@bloomberg.net

To contact the editors responsible for this story: Dana El Baltaji at delbaltaji@bloomberg.net, Andrew Langley, Andras Gergely

©2019 Bloomberg L.P.