Jul 12, 2022

IMF Cuts US Growth Forecasts Raises Jobless Estimates on Inflation Risks

, Bloomberg News

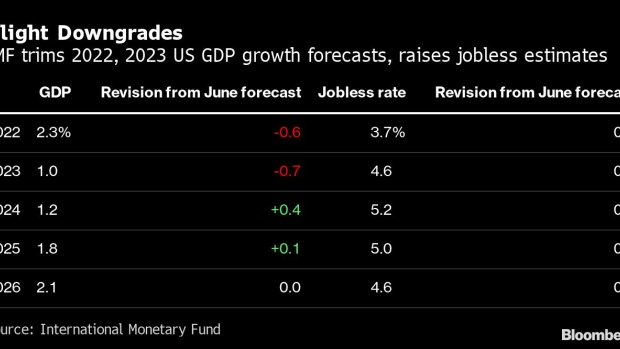

(Bloomberg) -- The International Monetary Fund cut its growth projections for the US economy this year and next, and raised its unemployment-rate estimates through 2025, warning that a broad-based surge in inflation poses “systemic risks” to both the country and the global economy.

Gross domestic product in the world’s biggest economy will expand 2.3% this year, the executive board of the Washington-based lender said in its so-called Article IV consultation released Tuesday. That’s less than the 2.9% it projected last month, when its staff concluded a visit for the report.

The IMF now also sees the jobless rate at 3.7% this year, compared with staff’s earlier 3.2% forecast, and expects the figure to exceed 5% in both 2024 and 2025.

The IMF didn’t provide any reason for the reduction in its US growth forecast from last month. But its new prediction comes in the wake of the June 30 release of Commerce Department data which showed that inflation-adjusted consumer spending fell in May for the first time this year and which also revised prior months’ expenditures lower.

The Federal Reserve has pivoted aggressively to fight the hottest inflation in 40 years amid criticism it left monetary policy too easy for too long as the economy recovered from Covid-19.

Policy makers raised interest rates by 75 basis points last month -- the single-biggest move since 1994 -- and a majority of Fed officials have signaled that another increase of the same magnitude is on the table for July.

US GDP contracted in the first quarter and trackers of economic activity, such as the popular Atlanta Fed indicator GDPNow, suggest it will do so again in the second quarter when data are release on July 28.

The US’s “policy priority must be to expeditiously slow price growth without precipitating a recession,” the IMF’s executive directors said. Avoiding a recession in the US “is becoming increasingly challenging,” with the Russian invasion of Ukraine, the lingering Covid-19 pandemic and supply-side constraints create additional difficulties, they said.

Directors recognized that calibrating the response to inflation comes with high stakes and that misjudging the policy mix -- in either direction -- will result in sizable costs at home and negative spillovers to the global economy, according to the statement.

Article IV consultations are the IMF’s assessment of countries’ economic and financial developments following meetings with lawmakers and public officials.

(Updates with Commerce Department consumer-spending data in fourth paragraph.)

©2022 Bloomberg L.P.