Mar 6, 2020

It's time to really worry, says manager who beat 98% of peers

, Bloomberg News

Global Coronavirus Cases Near 100,000

Markets aren’t prepared for how severe the fallout of the global spread of coronavirus could get and the turmoil has only just started, according to the manager of a peer-beating fund.

The stark warning comes from Allianz Global Investors’ portfolio manager Mike Riddell, who oversees US$4.7 billion for the company. “The speed of the market repricing has obviously been dramatic, however markets have only gone from pricing in no risk of anything to a moderate risk,” Riddell said in a phone interview. “Where we think markets can still move is in volatility.”

Riddell’s Strategic Bond Fund, which he manages with Kacper Brzezniak, outperformed 98 per cent of its peers in the past month, when markets grappled with record-low bond yields, a plunge in stock markets, spiking currency market volatility and surprise rate cuts from central banks, including an emergency cut by the U.S. Federal Reserve.

The London-based Allianz manager has been bracing for a wobble in markets for a few months now and thinks the recent repricing is still too mild. He is using options to bet on more currency swings and also has positioned for short-term U.S. yields to lead declines as he sees a significant chance the Fed could slash interest rates close to zero.

“If global data really tanks in the coming weeks and months, investors will realize that central banks can’t cure coronaviruses and markets such as currencies and corporate bonds are still ripe for a correction,” Riddell said.

The virus has spread from China to dozens of countries, with cases surging above 96,000 and the death toll exceeding 3,300. Governments in Asia and Europe have pledged over US$50 billion in budget measures, and the U.S. House of Representatives approved a US$7.8 billion emergency spending bill.

Fears of the infection and imposed quarantines have severely hit economic sentiment and activity. The Paris-based OECD slashed its global outlook by 0.5 per cent and warned the virus was pushing the world economy closer to a contraction.

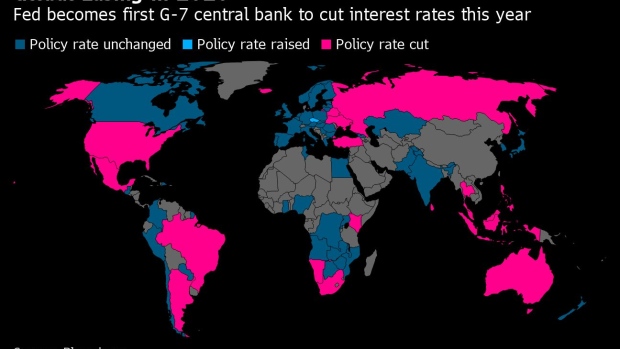

Central bankers are looking to dig deeper into their policy toolkit as they attempt to cushion any economic blow. Investors have been more aggressive with their expectations for monetary stimulus after the Fed’s surprise 50 basis-point cut on March 3. Markets appeared to take a breather on Wednesday before the slump continued in U.S. and European equities Thursday.

One-year implied volatility in euro-dollar, which climbed at the end of February to the highest since mid-2019, has since retreated to its average level for the past year of around 6 per cent. Riddell said positioning for increased currency swings via options was incredibly cheap in January

While he has trimmed some of these bets, with his view that the euro-zone economy is already in a recession, he expects currency volatility to be “twice as high” if the situation worsens. Despite U.S. and U.K. bond yields near record lows, Riddell doesn’t see this as a floor and has a “large” position in U.S. curve steepeners via swaps and futures.

“Even if we aren’t hysterical about the health impact of the virus, it doesn’t mean the market and economic impact is going to be muted,” he said.

“It is the quarantining and essentially the shutting down of large parts of the global economy which is causing substantial economic and financial market damage,” Riddell said. “My base case is things get substantially worse from now.”