Feb 27, 2019

Italy, failing on debt reduction, is a risk for Europe, EU warns

, Bloomberg News

The European Commission issued another sharp warning on Italy, saying the country’s massive public debt and long-lasting productivity weakness are risks for other countries in the region.

“Italy is experiencing excessive imbalances,” the Commission said Wednesday in its annual assessment of the economic and social situation in EU member states. “High government debt and protracted weak productivity dynamics imply risks with cross-border relevance, in a context of a still-high level of non-performing loans and high unemployment.”

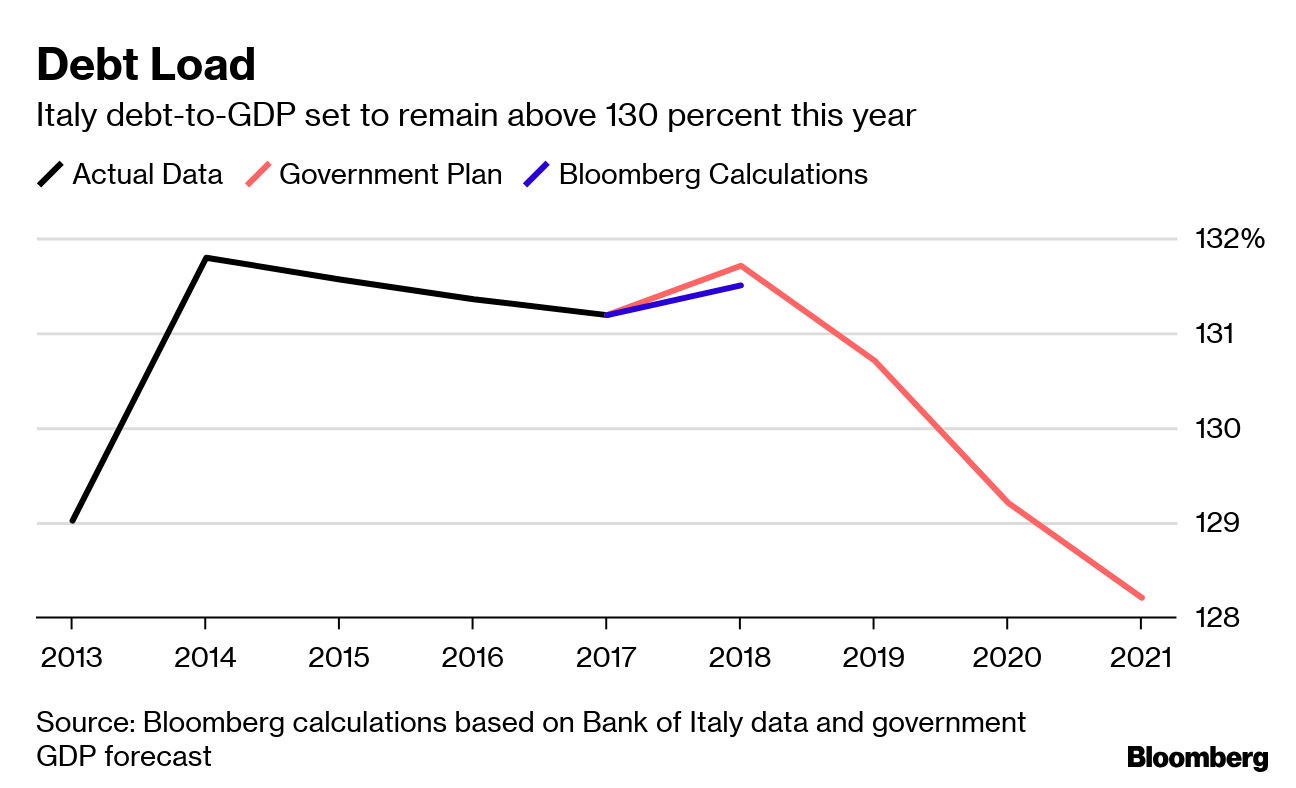

While stopping short of using the word “contagion,” the EU’s Brussels-based executive arm stressed how the nation’s problems affect others, and said “the government debt ratio is not expected to decline in the coming years.” Italy’s 2019 budget “includes policy measures that reverse elements of previous important reforms, in particular in the area of pensions,” the report said.

The euro region’s third-biggest economy entered a technical recession at the end of last year after contracting for two straight quarters. In December Premier Giuseppe Conte’s populist government reached a deal with the Commission on this year’s budget, after revising down the deficit target and the forecast for economic growth this year.

Weak Spot

There was further evidence on Wednesday of Italy’s position as the weak spot in the euro area. Economic sentiment in the country plunged in February, while an average for the currency region declined only modestly.

Uncertainty about the populist administration’s plans “resulted in slower economic growth” and weighed on the broader euro-area outlook, Commission Vice President Valdis Dombrovskis said in an interview with Bloomberg Television in Brussels earlier on Wednesday.

Italy’s recession is a serious concern, French Finance Minister Bruno Le Maire said last week in an interview with Bloomberg News, as the slump “will have a significant impact on growth in Europe and can impact France.”

The government targets a reduction of debt to 130.7 per cent of gross domestic product this year and 129.2 per cent in 2020.

Last week Fitch Ratings kept its negative outlook of Italy’s credit while warning that the extremely high level of general government debt poses a risk. Italian business and economic confidence fell this month, a separate report by Italy’s statistics office said on Wednesday.

The sentiment survey is “consistent with our view that the euro-zone economy will expand by about 1 percent this year, but that Italy’s economy will struggle to grow at all,” said Jack Allen, an economist at Capital Economics in London.