Mar 8, 2023

Japan’s Economy Struggles to Eke Out Growth in Fragile Recovery

, Bloomberg News

(Bloomberg) -- Japan only narrowly avoided a recession at the end of last year, a sign of continued weakness in the economy as inflationary pressure and a global economic slowdown cloud the outlook.

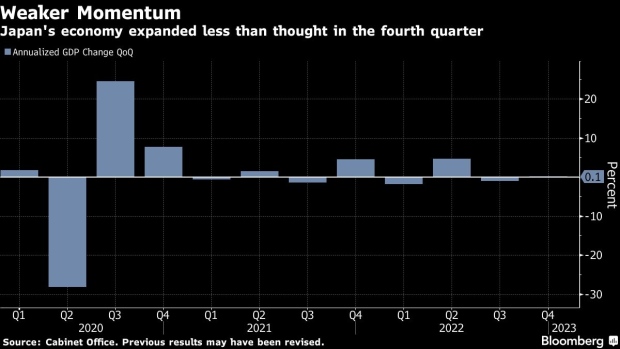

Gross domestic product grew at an annualized 0.1% in the fourth quarter from the previous period, revised figures from the Cabinet Office showed Thursday. That was significantly below both initial estimates and economist forecasts, and meant the country barely avoided two consecutive quarters of contraction.

Weaker consumer spending was the main factor behind the revision, rising less than initial estimates. The data suggested people went out less than expected during Japan’s latest Covid-19 wave, and reined in spending as prices rose. Such weakness supports the central bank’s view that Japan still needs help from easy monetary policy.

“Economic activity and the pace of recovery aren’t strong enough” for change from the BOJ, said Saisuke Sakai, senior economist at Mizuho Research & Technologies. “The BOJ will maintain its monetary easing framework for the time being.”

Markets remain on alert for a final surprise from Bank of Japan Governor Haruhiko Kuroda on Friday. But the central bank is leaning toward monitoring the impact of recent tweaks to its stimulus program rather than making another adjustment, according to people familiar with the matter.

During parliamentary hearings last month, BOJ governor nominee Kazuo Ueda also said that it’s appropriate for Japan to maintain monetary easing. That view was shared by his two deputy governor nominees. All three are expected to be approved by the lower house of parliament in a vote Thursday.

Read more: What We Learned About Bank of Japan Nominee Ueda From Hearings

What Bloomberg Economics Says...

“Looking ahead, we expect GDP growth to pick up slightly in 1Q as spending by domestic travelers and foreign tourists continues to support the economy. Government subsidies to reduce utilities costs should also slow inflation and increase household disposable income. Even so, weakening external demand will crimp exports – and increase the downside risks to the outlook.”

— Yuki Masujima, economist

For the full report, click here

Analysts largely agree that the country will undergo a gradual recovery, thanks to returning foreign tourists, domestic travel subsidies and Prime Minister Fumio Kishida’s stimulus package.

Still, factors including historic levels of inflation are expected to keep weighing on households and businesses’ activities.

As price gains continue to be elevated, real wages have fallen for 10 consecutive months, a key factor standing in the way of the BOJ achieving its sustainable 2% inflation goal. In a sign of ongoing concern, Kishida reportedly ordered fresh measures to help combat rising energy prices last week.

“The main reason behind the revised GDP numbers is a downward revision in consumption,” said Wakaba Kobayashi, an economist at Daiwa Institute of Research. “With the eighth wave of Covid-19 happening then, the pace of consumer recovery wasn’t that strong.”

Net trade provided the main driver of growth, partly helped by a turnaround in the yen, but the global slowdown casts doubt on how much exports can be relied upon to prop up the economy this year.

Although the pace of tightening from central banks has recently slowed, there have already been signs of cooling economic activity in the US and Europe. Slower global growth may also curb Japanese manufacturers’ otherwise relatively resilient appetite for investing.

China’s reopening is generally seen as a positive factor, but it’s unclear when that impact will fully kick in. Exports to China from Japan have declined for two straight months since December.

“I don’t think the economic slowdown in the US and Europe will be that severe,” said Mizuho Research’s Sakai. “I expect the Japanese economy to maintain positive growth in the January to March period, albeit only at a moderate 1% annualized growth rate.”

--With assistance from Emi Urabe.

(Updates with additional details, latest comment from Bloomberg Economics)

©2023 Bloomberg L.P.