Feb 14, 2024

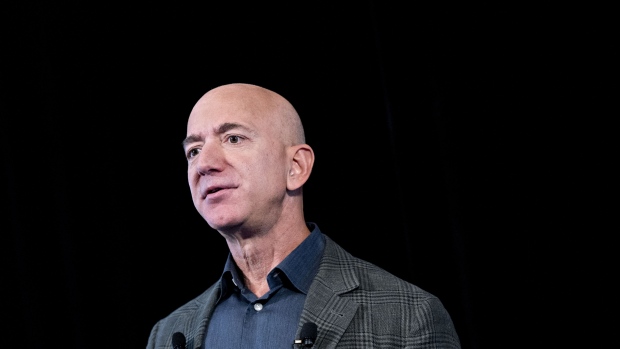

Jeff Bezos Reaps Florida Tax Benefit With $4 Billion Amazon Share Sale

, Bloomberg News

(Bloomberg) -- Jeff Bezos didn’t cite taxes among the reasons for his recent move to Miami from the Seattle region, but the fiscal benefits of his relocation to the Sunshine State are becoming very obvious.

Leaving Washington state, which in 2022 introduced a 7% tax on capital gains, could have saved Bezos $288 million in taxes after he unloaded $4 billion of Amazon.com Inc. stock in the past week.

Bezos said in November that was he moving to Florida, which doesn’t tax capital gains, from Seattle to be closer to his parents and the Cape Canaveral operations of his space-exploration company Blue Origin. The announcement came a week before he put in place a 10(b)5-1 plan to sell as many as 50 million Amazon shares, worth potentially more than $8 billion.

The world’s second-richest person has already flexed his prescence in his new neighborhood. The Amazon founder has spent $147 million to buy two homes in Indian Creek, a man-made barrier island known as the “Billionaire Bunker,” which he’s expected to tear down and replace with custom builds. But for the state Bezos left behind, it’s potentially missing out on tax revenue that could have gone to education and school construction — the designated recipients of Washington’s capital gains tax.

Read more: Billionaires Are Pricing Out Millionaires From a Florida Enclave

Spokespeople for Bezos and Amazon declined to comment on the stock sales.

It’s not clear how much Washington was counting on its richest former resident. The almost $900 million that the tax brought in last year on capital gains realized in 2022 blew past the state’s estimates. More than half of that revenue came from just 10 people, according to state officials.

Ballot Measure

Bezos’s move demonstrates how hard it is for states to pin down the most valuable taxpayers, especially in a post-pandemic world where people and businesses are finding it easier to shift location within the US. Miami especially has become a magnet for the ultra-rich and their businesses thanks to its low taxes and high quality of life. Several finance moguls, such as Ken Griffin and Josh Harris, have moved to the region in recent years, while Texas has also seen an influx of the wealthy from higher-tax states such as California and New York.

Washington’s capital gains tax could “disincentivize people to come here or incentivize them to leave,” said Aaron Johnson, tax counsel with Lane Powell, a law firm that challenged the capital gains tax in court. “Anybody who has the wherewithal and the ability to create tax efficiencies will.”

Like Florida, Washington state has no income tax. The capital gains tax was proposed as a way to capture some of the wealth concentrated in the state — which is home to corporate giants like Microsoft Corp. and Starbucks Corp. as well as Amazon.

The 7% excise tax went into effect Jan. 1, 2022 on gains over $250,000 per year, excluding retirement-account sales, real estate and certain small businesses. The Washington Supreme Court upheld it as a permissible excise tax in April, rejecting arguments from business groups that it’s an illegal income tax.

Billionaire Ken Fisher said in March he would move his firm from Washington to Texas, criticizing the capital gains tax and the court decision that upheld it.

The capital gains tax now faces a ballot measure likely to be before Washington voters in November seeking to repeal it. The initiative is one of six conservative ballot measures supported by Brian Heywood, a money manager based near Seattle who moved to Washington from California more than a decade ago in part to escape high taxes and regulation.

Read More: He Fled California Taxes. He’s Fighting Them in Washington

Heywood has said he’s concerned that Democrats who’ve long controlled Washington politics will build on the capital gains tax to try to implement a state income tax. He joined other anti-tax advocates in warning that these efforts will encourage the state’s wealthiest residents to leave or make Washington a less attractive place to start a business like Amazon in the first place.

©2024 Bloomberg L.P.