Feb 9, 2023

JPMorgan’s Dimon Says Fed May Hike Above 5%, Reuters Reports

, Bloomberg News

(Bloomberg) -- JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said the Federal Reserve may need to lift its benchmark interest rate above 5%, Reuters reported, after a slew of central bank officials stressed the need to keep hiking.

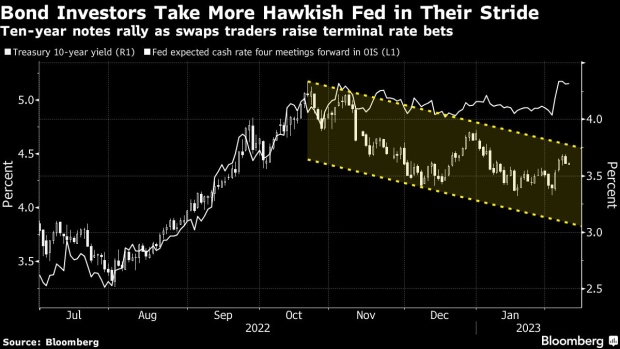

His comments come as traders ramp up bets that the US central bank will remain hawkish in the coming months. Swap rates now see the peak of the Fed’s tightening cycle at around 5.15% — that’s about a quarter point higher than was priced in last week.

“It’s perfectly reasonable for the Fed to go to 5% and wait a while,” Dimon told Reuters in an interview. But if inflation slows to 3.5% or 4% and stays there, “you may have to go higher than 5% and that could affect short rates, longer rates,” he said.

Dimon also said a default on US debt would be potentially “catastrophic” and could “destroy” the country’s future, according to Reuters. President Joe Biden this week vowed to not allow the US to default on its debt, calling on Congress to raise the debt ceiling.

Read a QuickTake explainer on the US debt ceiling

Dimon also said that he was planning to visit China, as it was important to maintain relations with the country, Reuters reported.

--With assistance from Garfield Reynolds and Adam Haigh.

©2023 Bloomberg L.P.