Oct 17, 2022

JPMorgan’s Kolanovic Trims Risk as He Turns More Wary on Economy

, Bloomberg News

(Bloomberg) -- JPMorgan Chase & Co.’s Marko Kolanovic is trimming risk allocations in the bank’s model portfolio as he grows more cautious about economic and market recoveries.

Kolanovic, who has been Wall Street’s most vocal bull this year, cut the size of his equity overweight and bond underweight allocations, citing increasing risks from central bank policies and geopolitics.

“Recent developments on these fronts -- namely, the increasingly hawkish rhetoric from central banks, and escalation of the war in Ukraine -- are likely to delay the economic and market recovery,” Kolanovic, JPMorgan’s chief global markets strategist, wrote in a note to clients late on Monday.

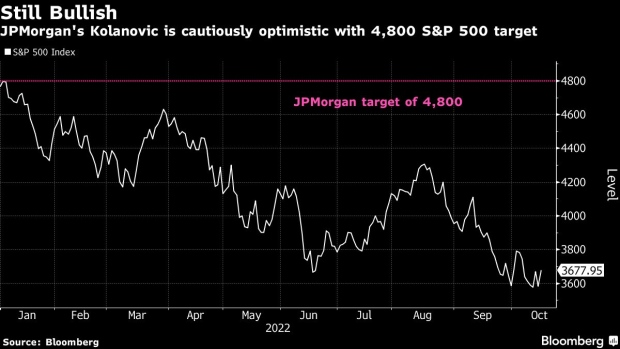

The move echoes similar comments earlier this month when Kolanovic said such risks might push the achievement of the bank’s year-end S&P 500 Index target of 4,800 into 2023. That target implies a gain of about 30% from the S&P 500’s closing level of 3,678 on Monday.

Kolanovic, voted the No. 1 equity-linked strategist in last year’s Institutional Investor survey, hasn’t had much success with his bullish calls so far in 2022. Over the summer he maintained that the US stock market was poised for a gradual recovery in 2022 and that the S&P 500 would likely end the year unchanged, repeatedly urging investors to buy the dip.

Kolanovic is sticking with a pro-risk stance overall given expectations for growth to recover in Asia and bearish investor positioning limiting further declines in stocks.

“We expect the global expansion to continue to display resilience through the middle of next year given an unwind of adverse supply shocks, a material slowing in inflation, and a healthy private sector,” he said.

©2022 Bloomberg L.P.