Nov 30, 2021

JPMorgan Says Omicron Won’t Stop the Global Equities Rally

, Bloomberg News

(Bloomberg) -- Omicron won’t derail the rally for global stocks, according to JPMorgan Chase & Co. strategists, adding another voice to the tone of cautious optimism in the market after the recent sharp pullback.

“Sporadic setbacks,” such as the emergence of omicron should be viewed “in the context of higher natural and vaccine-acquired immunity, significantly lower mortality, and new antiviral treatments,” strategists led by Dubravko Lakos-Bujas and Mislav Matejka wrote in a note. “We expect post-Covid normalization to continue to assert itself globally in 2022,” they said.

European and Asian stocks, along with U.S. equity futures, fell on Tuesday after Moderna Inc. Chief Executive Officer Stephane Bancel told the Financial Times that the omicron coronavirus variant could evade existing vaccines. Research is still underway to determine if the new strain causes the same level of illness as older versions, while developers including Moderna, Pfizer Inc. and BioNTech SE are working on new vaccines.

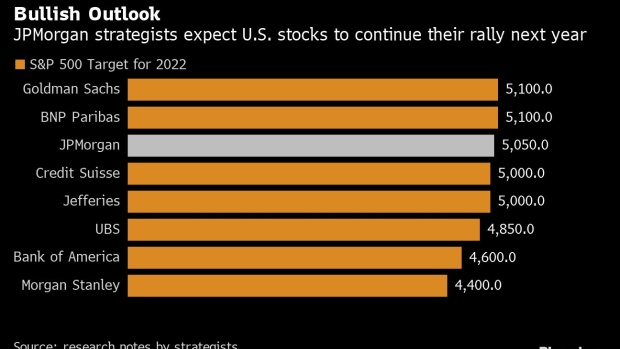

“We continue to see market upside, though more moderate, on better than expected earnings growth with supply shocks easing, China/EM backdrop improving, and normalizing consumer spending habits,” JPMorgan said on Tuesday, forecasting that the S&P 500 will rise about 9% to 5,050 by end-2022. The key risk that the strategists see is a hawkish shift in central bank policy.

©2021 Bloomberg L.P.