Dec 15, 2022

Junk Bond Markets Shouldn’t Fight the Fed, Vanguard’s Chang Says

, Bloomberg News

(Bloomberg) -- The junk bond market seems to believe it can fight the Federal Reserve. Some investors say that’s a bad bet to make.

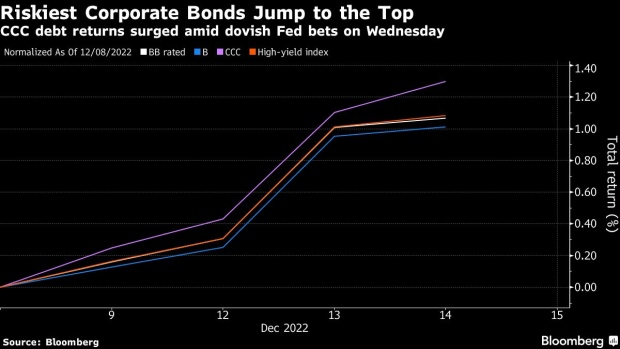

The Federal Reserve said on Wednesday it isn’t close to ending its rate hiking campaign as it tries to tamp down inflation, and boosted its projections for how high rates will go. Bond markets largely shrugged off the potential for more tightening, with the riskiest high-yield notes, those rated in the CCC tier, notching the highest gains for junk debt on Wednesday, rising 0.2%. That debt has outperformed for the last week.

Bond investors may question the Fed’s resolve, but money managers should be particularly careful now, said Michael Chang, senior portfolio manager for high-yield credit at Vanguard. If the central bank hikes rates more than expected and succeeds in slowing economic growth, the lower end of the credit spectrum will be disproportionately hit, he said on Thursday.

“The general macro environment continues to soften and weaken as we enter 2023, and weaker economic conditions are generally not good for high yield,” Chang said last week in a separate interview. “We’ve been pretty cautious on high yield and we remain cautious.”

There’s good reason to be concerned about the macro environment now. A report Thursday morning said that US retail sales fell in November by the most in nearly a year, with nine of 13 categories dropping. Federal Reserve officials cut their growth outlook for the US for next year to 0.5%. Inflation decelerated more than expected in November.

In the near term, leveraged loans might get hit harder than junk bonds, Chang said. Borrowers in loans tend to have lower credit ratings, and because the debt carries floating rates, funding costs rise faster than for fixed-rate junk bonds when the Fed hikes. On top of that, loan borrowers face more maturities next year.

Spread Widening

To the extent that junk bond prices fall, most investors don’t expect them to plunge. Speculative-grade companies have had ample opportunity to sell debt over the last few years, so there are relatively few bonds that need to be refinanced next year. And companies are entering 2023 with relatively strong balance sheets compared to prior downturns.

But there’s room for the securities to get a little weaker, said Anders Persson, chief investment officer for global fixed income at Nuveen. Risk premiums on US junk bonds are averaging just 4.3 percentage points, far below levels usually associated with market stress and below the average since January 2009 of about 5.1 percentage points.

“We’re growing a bit more wary toward credit risk as recession indicators rise, which could cause some spread widening,” Persson said.

Nuveen likes investment-grade bonds and sees opportunities for investments in the high-quality segments of the speculative-grade space. But they are cautious on the lowest-rated parts of high yield such as CCC rated credit.

The potential outcomes for 2023 vary widely, according to Citigroup Inc. strategists Michael Anderson and Steph Choe. Cheaper valuations and steadier Treasury yields “raise the prospects for a bounce-back year,” they wrote in a note last week. Pressure on earnings and balance sheets, however, will likely accelerate as tighter monetary policy pressures economic growth.

“We expect returns will improve across the board in 2023, but that does not mean markets are out of the woods,” the Citi strategists wrote. The bank expects “solid returns” in higher-quality, duration-sensitive bonds, while it anticipates lower-quality debt to “struggle to keep pace.”

And some strategists see potential opportunities among junk debt next year. UBS Group AG said last month that junk bonds can potentially gain 14% in 2023. Goldman Sachs Group Inc. strategists see total returns of about 12%, the higher end of the historical range.

But even if junk bonds are due to rise in 2023, there may be opportunities to buy at cheaper levels coming up in the next few months, said Nichole Hammond, senior portfolio manager at Angel Oak Capital Advisors.

“Current spreads do not incorporate recession risk,” Hammond said. “Our base case is that the Fed’s tightening campaign will likely cause a mild recession in 2023 which will weaken corporate fundamentals and cause spreads to widen.”

Elsewhere in credit markets:

Americas

The spread on the Markit CDX North American Investment Grade, a measure of perceived risk in credit markets, extended its march wider after the Federal Reserve signaled that interest rates will likely end next year above 5%.

- Some lenders to Apollo Global Management’s Covis Pharmaceuticals Inc. have tapped advisers in hopes of addressing the company’s high debt load, less than a year after the financing was sold to investors

- Hess Corp. put a subsidiary into bankruptcy to try to avoid litigating hundreds of asbestos lawsuits tied to an oil refinery it no longer owns. Now workers from that unit are focusing on suing Hess instead

- US high-yield bonds across sectors — including health care and cruise lines — saw their prices fall Thursday after the European Central Bank and Federal Reserve hiked interest rates 50 basis points to quell inflation

- Blackstone is considering strategic options for Japanese specialty drugmaker Ayumi Pharmaceutical, according to people familiar with the matter

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

EMEA

There are no deals being offered in the region’s primary market on Thursday, taking the number of zero-sales days this year to 49 and well above a previous full-year record.

- KfW, Canadian Imperial Bank of Commerce, Dexia Credit Local and Deutsche Bank head up at least €55b-equivalent of high-grade corporate and SSA euro and pound debt coming due next month, according to data compiled by Bloomberg

- Almost €190 billion of Europe high-grade syndicated borrowings including revolving, letter of credit and guarantee facilities due next year could be refinanced or extended. Almost €170 billion wasn’t tied to sustainability goals, raising the prospect that maturing deals could be linked to borrowers’ ESG targets when they’re refinanced

- High inflation and rising interest rates will weaken the performance of assets backing covered bonds in 2023, according to Moody’s Investors Service

Asia

Default-swaps insuring Asia ex-Japan high-grade dollar bonds fell near to the lowest in June after the US Federal Reserve’s latest meeting. The gauge has been on an easing streak for much of this week.

- A selloff in China’s local bond market is showing signs of easing, with yields declining across the board as authorities asked some of the nation’s biggest banks to help restore stability

- Investors should take a cautious approach to Asian high-yield dollar bonds because of higher refinancing costs next year, according to Ting Meng, senior Asia credit strategist at ANZ in an interview

- India’s biggest pension fund, with more than 15 trillion rupees ($182 billion) in assets, has resumed investing in rupee bonds issued by top-rated private firms as surging inflows pushes it to look for newer avenues to deploy cash, a top official said

©2022 Bloomberg L.P.