Oct 31, 2022

Junk Debt in Southeast Asia Loses Most Since 2020 as Risks Mount

, Bloomberg News

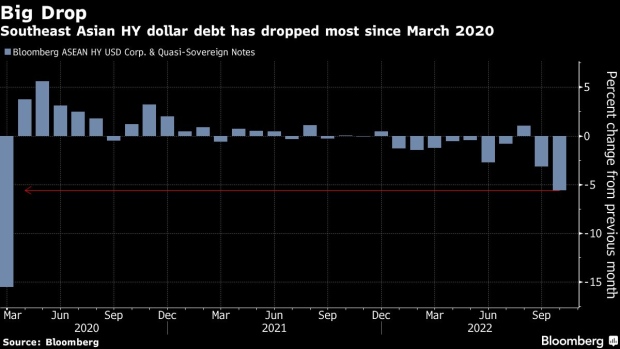

(Bloomberg) -- High-yield corporate bonds in Southeast Asia suffered their biggest monthly blow in more than two years in October, as recession risks and higher rates put pressure on their finances.

The Bloomberg index for the region’s junk corporate dollar debt are set to have lost 6% in October, underperforming a gauge that includes both investment and speculative-grade bonds in the region. That’s the biggest monthly drop in returns since March 2020, if the losses through Oct. 28 hold.

US-currency borrowing costs for junk-rated firms in the region have already more than doubled this year and now average 12.1%, the index shows.

The Federal Reserve may unleash another 75 basis-point interest-rate hike this week in a show of aggression toward inflation, even in the face of mounting recession risks. That would probably push up borrowing costs for corporates even higher.

Real estate firms with Indonesian operations are among the companies affected by higher interest rates. The US currency debt of LMIRT Capital due 2026 lost 16% in October.

©2022 Bloomberg L.P.