Jun 6, 2023

Just 5% of Passive ESG Fund Investments Make Climate Impact, Study Says

, Bloomberg News

(Bloomberg) -- Most of the money invested in passively managed mutual funds that track ESG indexes fail to help fight climate change, according to a new study.

“While ESG indices could potentially have a sustainability impact, most currently don’t meaningfully facilitate sustainability,” economists, including Jan Fichtner at Germany’s Bundesbank and Johannes Petry at Goethe University, wrote in the paper. They call it the “ESG capital-allocation gap.”

The study looks at the intersection of two major trends that have swept the world of finance in recent years: the growing popularity of index-tracking funds offered by asset managers led by Vanguard Group and Blackrock Inc. and the rush to label a wide variety of investment products ESG as money managers faced more pressure to steer funds towards companies that aren’t major contributors to climate change.

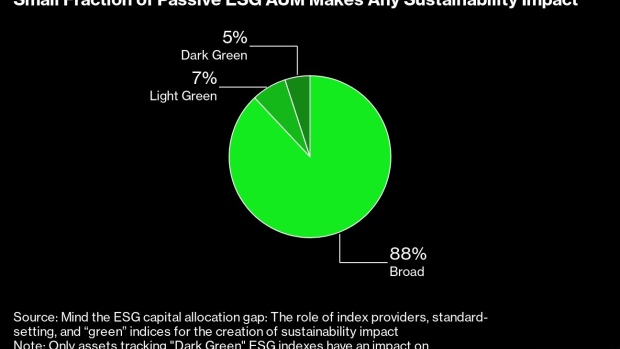

It divides environmental, social and governance gauges compiled by the major index providers into three categories: “broad,” “light green” and “dark green.” Only dark green indexes represent “genuinely sustainable assets”, while broader, passively run ESG indexes have very little sustainability impact.

In a dataset accounting for roughly $190 billion of assets under management, the researchers found that only 5% followed dark green indexes.

©2023 Bloomberg L.P.