Mar 5, 2023

Kuroda’s Decade at the BOJ Changed How Japan’s Banks Make Money

, Bloomberg News

(Bloomberg) -- The unprecedented monetary easing by the Bank of Japan over the past decade has reshaped the nation’s lenders, from their asset holdings to loan income. That may be about to change as the central bank prepares to take on a new chief next month.

Governor Haruhiko Kuroda, who introduced negative interest rates, will hold his last policy meeting this week before handing over the reins to Kazuo Ueda. As investors prepare for an eventual normalization of monetary policy, here are the major areas where banks were impacted and how these could change.

Japanese Government Bond Holdings

The BOJ’s massive stimulus measures, often called the “Kuroda Bazooka” by market participants, drove down yields on Japanese government bonds (JGBs), forcing banks to make major changes to their portfolios.

Even though JGBs traditionally made up a large portion of banks’ securities holdings, as they were considered to have minimum default risks and offered the ease to cash out when necessary, lenders had to look elsewhere to boost returns.

The most notable case is Japan Post Bank Co., a unit of a former state-run mail services giant, which manages most of almost $2 trillion of assets in its securities portfolio. Where it once invested as much as 80% of its money in JGBs, this now accounts for less than 20%. Instead, the bank has rapidly built up its holdings of foreign bonds and other securities to 78 trillion yen ($572 billion), accounting for about 35% of its entire portfolio.

Many economists expect the central bank’s next move may be to further tweak or even remove its policy of controlling bond yields. Higher yields on JGBs could one day lure back Japanese banks but an immediate shift is unlikely, according to Bloomberg Intelligence Senior Analyst Pri de Silva.

Domestic Lending Income

Even before Kuroda took the reins, interest rates on loans were low, earning as little as 0.962% on average for new borrowings as of March 2013, according to BOJ data. His stimulus measures added further downward pressure, such that a decade later, the most recent lending rate is even lower at 0.704%. These rates have remained below 2% for more than 20 years.

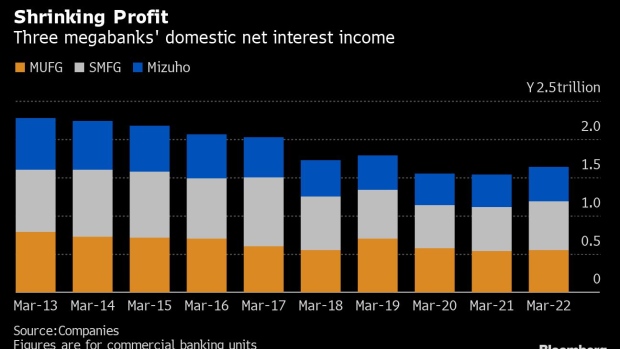

Domestic net interest income at Japan’s three megabanks has fallen by nearly 30% over the past 10 years. This income from loans and bond holdings once made up the bulk of their profits.

“For financial institutions, it is a fact that there are negative impacts such as a fall in spreads and deterioration in the investment environment,” Junichi Hanzawa, chairman of the Japanese Bankers Association and chief executive officer of MUFG Bank Ltd., told a recent news conference.

Bank executives have said their domestic lending business will get a boost once the BOJ starts raising policy rates. Even so, they aren’t expecting a Federal Reserve-style rapid succession of rate hikes, anticipating instead a milder, incremental approach. Toyoki Sameshima, an analyst at SBI Securities Co., sees banks’ interest rates staying flat or rising in the future, since they’ve already fallen to very low levels.

Share Prices

Japanese bank stocks languished during much of Kuroda’s tenure, especially after the central bank introduced its negative-rate policy in 2016. Their performance got a boost in late December when the BOJ made a surprise tweak to its yield curve control, which markets saw as heralding the possible start of monetary tightening. Already, an index of banking stocks has gained almost 10% so far this year, outperforming the benchmark Topix index.

Still, Ueda might not take action immediately upon becoming the governor, as he said underlying inflation needs to show a major shift to change the course of monetary policy.

Overseas Expansion

Japan’s biggest banks turbo-charged their overseas expansion over the past decade. Diminishing returns from domestic loans and bond investments pushed them to seek growth in the US and Asia, where they often paid healthy premiums to buy or invest in other firms.

From jumbo deals like Mitsubishi UFJ Financial Group Inc. buying Thailand’s Bank of Ayudhya Pcl to Sumitomo Mitsui Financial Group Inc. acquiring Indonesia’s Bank BTPN Tbk and Mizuho Financial Group Inc. pouncing on a portfolio of North American loans, the megabanks have been on a hunt. They’ve spent more than $35 billion on at least 90 deals over the past decade, according to data compiled by Bloomberg.

Japanese banks now have more cross-border exposure than their counterparts in other developed nations. The three megabanks’ overseas operations now account for 40-50% of their overall profits, up from 20-30% a decade ago. Due in large part to their overseas expansion, their total assets have grown by over 60%.

Dealmaking is expected to continue. The country’s rapidly aging population poses an existential threat, making it unavoidable for lenders to seek future growth outside Japan. Megabanks are likely to continue their aggressive search for overseas assets. For many regional banks, which cannot afford such options, there could be more consolidation.

--With assistance from Cormac Mullen, David Morris and Julie Chien.

©2023 Bloomberg L.P.