Dec 21, 2022

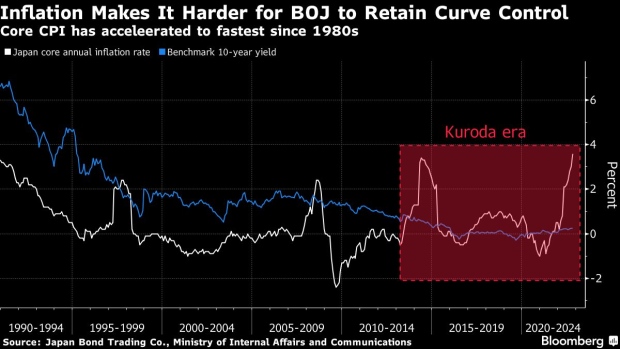

Kuroda’s Wider Yield Band Facing Immediate Test From Inflation

, Bloomberg News

(Bloomberg) -- The Bank of Japan responded to market pressure this week by unexpectedly increasing its band for the 10-year bond yield. The new ceiling is already coming under threat.

The benchmark yield jumped to as high as 0.48% Wednesday, the day after the BOJ doubled the top of its allowable range to 0.5%. Similar-maturity swap rates have increased to 0.74%, indicating traders are anticipating yields will break above that level. One immediate trigger may be Friday’s inflation data.

“The bond market could fall and put pressure on the BOJ again,” said Ayako Sera, a strategist at Sumitomo Mitsui Trust Bank Ltd. in Tokyo. “The BOJ will work hard to defend the 0.5% ceiling” but the yield is expected to stay around that level going forward amid elevated inflation, she said.

Japan’s national consumer prices excluding fresh food probably increased by 3.7% in November from a year earlier, the highest level since 1981, according to a Bloomberg survey of economists.

BOJ Governor Haruhiko Kuroda and his colleagues jolted global markets on Tuesday by widening the target band for the central bank’s yield-curve control, sending yields soaring at home and abroad as investors saw the move as the end of its ultra-dovish monetary policy.

Boosting Purchases

The central bank pushed back against that interpretation, saying the decision was aimed at improving domestic trading conditions. At the same time, the BOJ has sought to rein in the surge in yields by increasing purchases. The monetary authority offered to buy more than ¥1.3 trillion ($9.9 billion) three- to 10-year debt in its latest additional operation on Thursday.

The weight of BOJ buying saw the 10-year yield drop back to as low as 0.385% Thursday, though it’s still up from 0.25% at the end of last week.

New Battleground

Yields on other bond maturities have also risen. The two-year yield briefly climbed above zero for the first time since 2015 on Wednesday, while the five-year yield surged to 0.26% Tuesday, the highest since 2013.

The BOJ’s next move may be to ditch its negative-rate policy to enhance the functioning of the local bond market, Goldman Sachs Group Inc. said this week in a research note.

Read More: Why BOJ’s Small Tweak to Bond Yields Was a Bombshell: QuickTake

Others see the five-year bond as the next battleground between the BOJ and traders sensing a further relaxation of its policy.

“Five-year note will be the war zone for speculation” of a possible hike in the short-term interest rate, Chotaro Morita, chief rates strategist at SMBC Nikko Securities Inc. in Tokyo, wrote in a note.

--With assistance from James Hirai.

(Updates yield level in the seventh paragraph.)

©2022 Bloomberg L.P.