Nov 15, 2019

Lebanon Bond Sell-Off Eclipses Argentina as Unrest Flares Up

, Bloomberg News

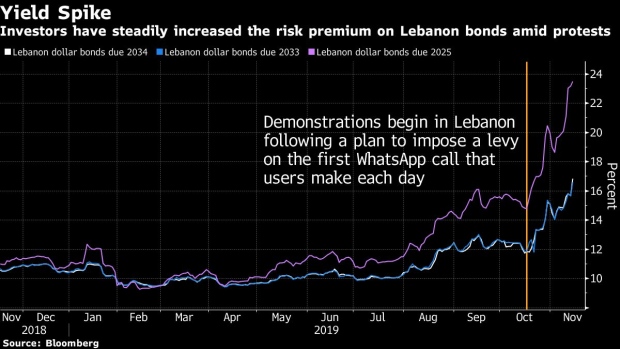

(Bloomberg) -- Lebanese bonds have overtaken Argentine debt as the second-worst performer this year, showing the financial toll that the social uprising has taken on one of the world’s most indebted nations.

Investors in Lebanon’s dollar-denominated notes have lost 30% this year, eclipsing the 27% decline for holders of Argentine securities. Lebanese notes maturing in 2034 fell 7% on Friday, the worst for sovereign dollar bonds in emerging markets. Its 2033 is the next worst-performing among developing nations.

S&P Global Ratings downgraded Lebanon’s long-term foreign currency debt rating to CCC from B- after the market closed on Friday, following the rating company’s decision to downgrade three of the nation’s top banks the previous day.

The nation has been without a government since Saad Hariri resigned late last month in the face of mass demonstrations demanding the removal of a ruling elite blamed for corruption and mismanagement. The situation has deteriorated so much that the Lebanese army was deployed heavily across the country this week as protesters began to converge on the presidential palace.

Argentina’s overseas bonds reached new lows this week as investors await clarity on how President-elect Alberto Fernandez plans to save the nation from a looming default and dwindling reserves. Venezuelan debt has lost investors 55% this, the world’s worst performance.

(Updates with nation’s debt rating downgrade by S&P in third paragraph)

--With assistance from Justin Villamil.

To contact the reporter on this story: Andres Guerra Luz in New York at aluz8@bloomberg.net

To contact the editors responsible for this story: Carolina Wilson at cwilson166@bloomberg.net, Brendan Walsh

©2019 Bloomberg L.P.