Mar 2, 2023

Lithium Miner SQM Counters Goldman Pesimism With Upbeat Outlook

, Bloomberg News

(Bloomberg) -- Lithium producer SQM delivered an upbeat outlook for the battery metal, forecasting demand to grow by about 25% this year and stepping up investments to meet booming electric-vehicle sales.

Positive guidance Thursday from the world’s No. 2 lithium producer contrasts with that of Goldman Sachs Group Inc. analysts, who warned last month that a recent price pullback from record highs has much further to run given falling Chinese demand.

The contrasting sentiment centers around the impact of China removing EV subsidies and Covid-related disruptions at a time of growing supply. Santiago-based SQM said Thursday that fundamentals remain strong, with EV sales improving in recent weeks in China and increasing in the US following the Inflation Reduction Act.

In its quarterly earnings statement, Soc. Quimica & Minera de Chile SA, as SQM is formally known, laid out a $3.4 billion capital expenditure plan for 2023 to 2025, with more than half earmarked for the battery metal.

It expects to increase Chilean lithium capacity to 210,000 metric tons — including 100,000 tons of hydroxide capacity — as it sees demand soaring to almost 1.5 million tons by 2025. SQM allocated $1.85 billion to increase capacity of the metal in Chile and invest in a project in Australia. By comparison, 2022 capex was $900 million, according to last year’s earnings statement.

The company has reached a run-rate of 180,000 tons of lithium products in Chile, and earnings were at $1.15 billion in the fourth quarter, in line with analyst estimates. Full-year earnings last year were $3.9 billion, more than six times higher than in 2021.

Shares Down

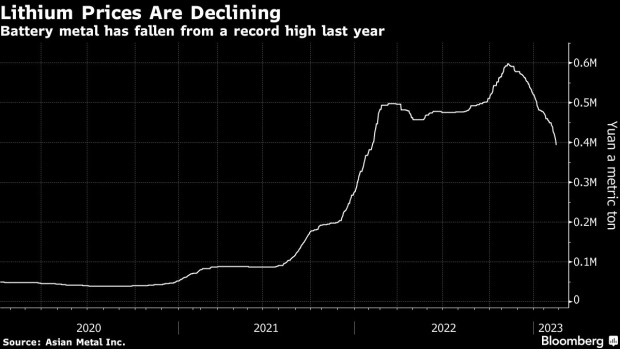

Producers are yet to feel the full brunt of the retreat in lithium carbonate that started in mid-November after prices skyrocketed over the previous year and a half on surging demand from carmakers rushing to meet ambitious electric vehicle targets.

Shares in lithium miners and battery makers have also slumped, with SQM and rival Albemarle Corp. both down sharply in the past month. Albemarle said two weeks ago it expected Chinese EV sales to remain strong despite the phasing out of subsidies this year.

SQM shares were down 4.4% at 10:55am in New York.

SQM is also targeting its project in Australia to be producing spodumene, a lithium ore, from the Mt. Holland site by the end of the year, and lithium hydroxide during the first half of 2025, Chief Executive Officer Ricardo Ramos Rodriguez said in a statement. Its refinery in Sichuan province in China is expected to be completed next quarter, and it will continue to invest in lithium exploration, he said.

--With assistance from Philip Sanders.

(Updates with more precise demand forecast from call with analysts)

©2023 Bloomberg L.P.