Aug 20, 2019

Look to 2009 as Precedent for Modern-Era German Fiscal Stimulus

, Bloomberg News

(Bloomberg) -- Terms of Trade is a daily newsletter that untangles a world embroiled in trade wars. Sign up here.

Germany’s tentative steps toward a fiscal stimulus program to revive its flagging economy are a signal that the nation could be in for an unusually severe slump.

Since a spending splurge when the country reunified in 1990, the government has only once deliberately ramped up expenditures to revive growth. That was during the global financial crisis in 2008-2009 when it announced a 50 billion-euro ($55 billion) package as global growth tanked.

Now, with the Bundesbank warning that Europe’s largest economy might be on the verge of a recession, and at risk of being the next target for U.S. President Donald Trump’s trade tariffs, the moment might be approaching to step in again.

Chancellor Angela Merkel’s government is considering measures to bolster domestic output and consumer spending to prevent large-scale unemployment, according to people familiar with the matter, and Finance Minister Olaf Scholz has said the government can muster 50 billion euros again if needed.

Financing wouldn’t be a problem -- debt yields are at record lows and Germany will sell a 30-year bond at a 0% coupon for the first time on Wednesday -- though Scholz would need to find a way around constitutional rules that limit government spending.

So did the 2009 splurge work? It was certainly followed by a strong rebound in growth, but it’s hard to judge how much of that was due to the stimulus and how much would have happened anyway, bolstered by the labor-market reforms the country implemented only a few years previously.

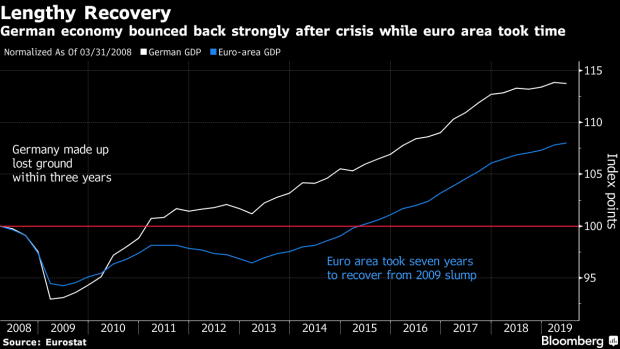

What is clear though is that the package was relatively large -- compared with 26 billion euros in France, for example -- and the upturn was fast. Germany took three years to make up the ground lost during the recession, less than half the time needed by the euro area as a whole.

At the height of the crisis, the government stepped in to help companies pay wages, allowing them to hold on to workers for when demand picked up again. Thanks to that “short-work” initiative, 330,000 jobs were saved in 2009 alone.

The program is drawing interest again, with the number of people enrolled trending higher over the past year.

Another measure to help Germany survive its worst recession since World War II was a cash-for-clunkers program. People got a 2,500 euro incentive to junked their old car and buy a new one. It was a measure targeted at the heart of Germany’s manufacturing sector, the same part of the economy that is leading the current slump.

What Bloomberg’s Economists Say...

“The German government has raised the possibility of a 50 billion euro package, which would do a lot to help, and if it is well targeted could undo much off the damage already done. But delaying the release of that spending until a recession is in train would be a missed opportunity.”--Jamie RushRead his GERMANY INSIGHT

A close look at economic growth suggests the government’s measures may have supported domestic spending through the crisis. Household consumption flatlined over the period and a decline in investment was arrested. In contrast, exports -- which the government had no control over -- plunged.

This time around, Berlin is considering options such as incentives to improve energy efficiency of homes, promote short-term hiring and boost income through social welfare, according to people familiar with the work under way. That sounds like a modern-day echo of the 2009 program.

--With assistance from Carolynn Look and Piotr Skolimowski.

To contact the reporter on this story: Jana Randow in Frankfurt at jrandow@bloomberg.net

To contact the editors responsible for this story: Fergal O'Brien at fobrien@bloomberg.net, Paul Gordon, Brian Swint

©2019 Bloomberg L.P.