Aug 17, 2022

Lowe's results look better than feared even with U.S. housing slump

, Bloomberg News

Stan Wong discusses Home Depot vs. Lowe's

Lowe’s Cos. reported profit that beat estimates even as home renovators wrestle with a slumping US housing market and the highest inflation in decades.

Earnings per share in the fiscal second quarter ended July 29 were US$4.67, topping the US$4.61 average estimate of analysts surveyed by Bloomberg. Lowe’s said Wednesday that it now sees operating income and earnings per share this year toward the top of its prior outlook. On the flip side, comparable sales unexpectedly fell in the quarter, and Lowe’s now expects annual sales to be closer to the bottom end of its forecast range.

“Results may have been better than feared given the challenging macroeconomics,” Bloomberg Intelligence analyst Drew Reading said. “An expanded operating margin despite lower sales reflects Lowe’s improved operational execution.”

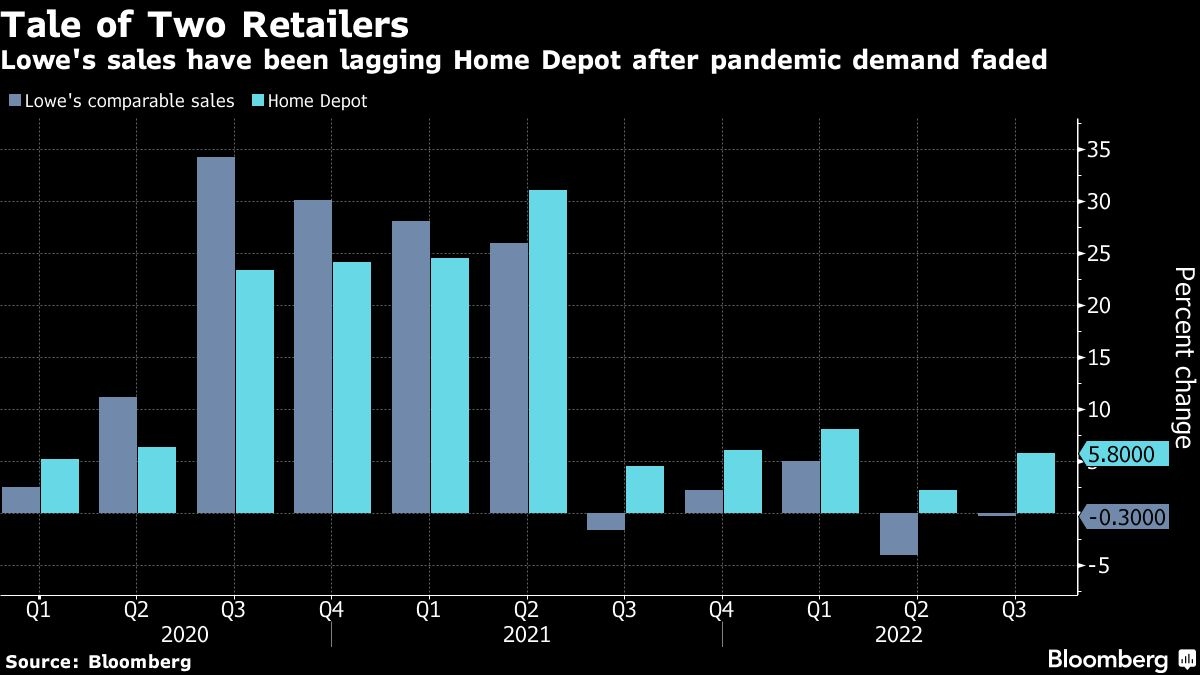

Lowe’s revenue is trailing rival Home Depot Inc. in part because Lowe’s generates 75 per cent of its sales from do-it-yourself customers, who are feeling the pinch of rising food and gas expenses. Combined with high mortgage rates and a deteriorated economy, the once-booming US housing market now looks to be sputtering. Lowe’s said sales to nonprofessional customers were hurt last quarter by the shortened spring season and lower demand in certain discretionary categories.

Shares of Lowe’s rose 1.3 per cent at 9:47 a.m. in New York. That’s on top of a 2.9 per cent gain on Tuesday after Home Depot results beat estimates.

Lowe’s has been trying to bolster sales to professional contractors, which has traditionally been Home Depot’s forte. Lowe’s said its sales to professional customers rose 13 per cent last quarter. That customer base is more resilient to inflationary pressures.

Home Depot generates around 55 per cent of its revenue from sales to do-it-yourself customers.

Comparable sales were strongest in July and that momentum has “continued to improve” in August, Lowe’s Chief Executive Officer Marvin Ellison said in an interview. Profitability has also been helped by a better pricing strategy in recent quarters that reflects differences in the cost structure for various cities, he said.

Ellison said he’s optimistic about the outlook for home renovators despite the cooling US housing market. Aging properties and higher real estate prices are trends that will underpin demand for Lowe’s products, he said.

“What is bad for the home builder is not always bad for the home-improvement market,” Ellison said.