Oct 29, 2021

Microsoft dethrones Apple as world's most valuable stock

, Bloomberg News

Greg Newman discusses Microsoft

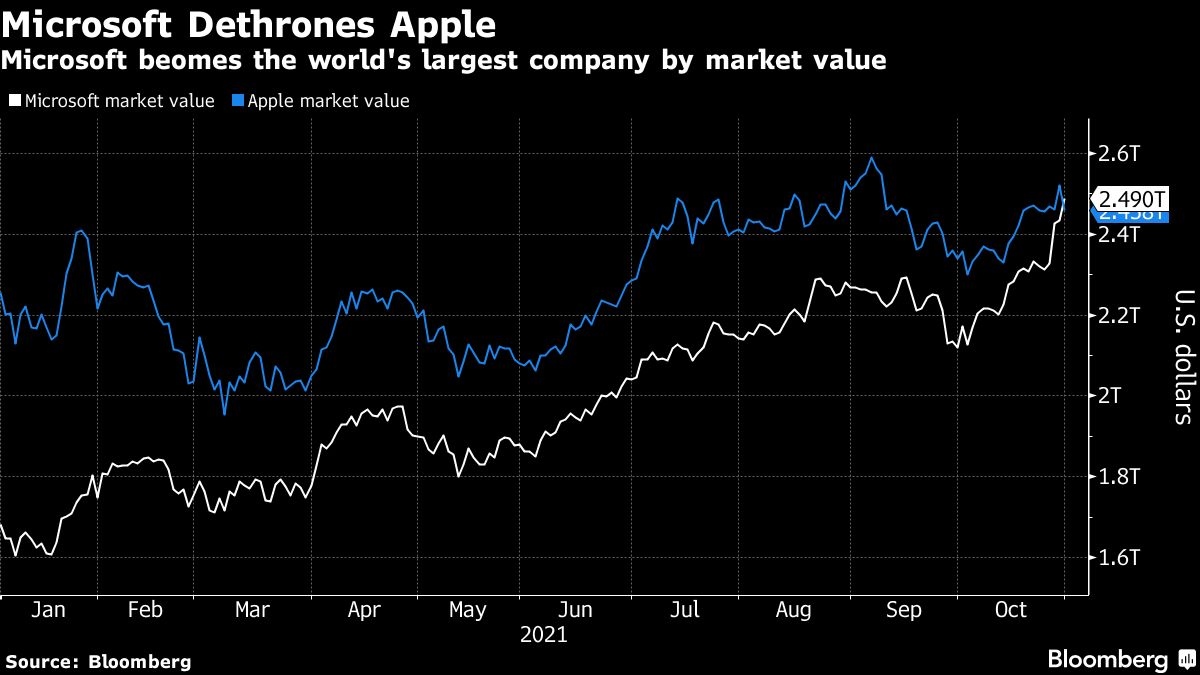

The slump in Apple Inc.’s shares on Friday propelled Microsoft Corp. to the position of the world’s largest listed company by market capitalization.

Apple fell 1.8 per cent after reporting fourth-quarter revenue that came in below the average analyst estimate, which gave the iPhone maker a market value of US$2.46 trillion. Microsoft rose 2.2 per cent to hit a market value of US$2.49 trillion, blowing past Apple after reporting estimate-topping results for an 11th straight quarter earlier this week.

“If you’re looking for safety in tech, Microsoft probably seems like a safer bet to me than Apple,” Michael Matousek, head trader at U.S. Global Investors, said in a phone interview. “If there was a downturn in the economy, I would expect Microsoft to stand up better, because its products are diversified across more businesses.”

The last time Microsoft dethroned Apple was in the first half of 2020 as investors flocked into growth stocks amid the COVID-19 pandemic. Microsoft notched its best weekly gain since November.

In June, Microsoft took its place in the history books as just the second U.S. public company to reach a US$2 trillion market value, buoyed by bets its dominance in cloud computing and enterprise software will expand further in a post-coronavirus world. Its shares have outperformed Apple and Amazon.com Inc. this year on expectations of long-term growth for both earnings and revenue, and expansion in areas like machine learning and cloud computing. Microsoft is up more than 49 per cent, while Apple is about 13 per cent higher and Amazon is up more than 3 per cent.

Its shares aren’t cheap, trading at a 20 per cent premium to the technology-heavy Nasdaq 100 Index. But lofty valuations haven’t stopped investors from adding to their positions in tech stocks this year. The Nasdaq 100 Index is on pace with the S&P 500 Index with a more than 22 per cent rally each and the Nasdaq Composite is up about 20 per cent.

“Size begets size and strength begets strength. This is the sort of thing that is nice to see; Microsoft was a rock star in the 90’s -- one of the four horsemen -- and it has clearly gotten its mojo back,” Matousek said.