Apr 11, 2021

Mideast Two-Year Financing Needs Rise to $919 Billion, IMF Says

, Bloomberg News

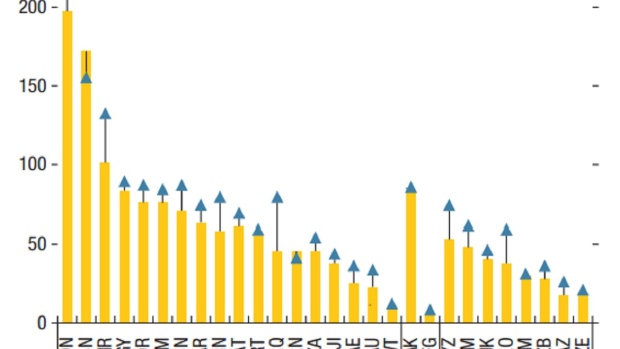

(Bloomberg) -- Financing needs in the Middle East and North Africa are expected to reach $919 billion for this year and next as the region seeks to recover from the coronavirus pandemic, according to the International Monetary Fund.

In an updated outlook published Sunday, it said public-financing requirements were likely to remain above 15% of gross domestic product in most parts of the region through the end of 2022.

The global lender revised its MENA growth projections upward to 4% in 2021, from an earlier estimate of 3.1%. The IMF expects output to expand 3.7% next year, but the improvement will ultimately be determined by the speed of vaccine rollouts, said Jihad Azour, director for the region.

“The recovery has started, but it has started on a divergent path,” he said in an interview. “Our first message is countries need to accelerate vaccinations, give it the first priority. Regional cooperation is welcome.”

The IMF upgraded its global economic growth forecast this month, while warning that advanced nations would be less affected by the virus in 2021 than low-income ones where inoculation programs lag.

Read: Special Drawing Rights, the IMF’s Imperfect Tool: QuickTake

In the wider MENA and central Asia region, financing needs will be at least $300 billion higher in 2021 and 2022 than in the previous two-year period, totaling $1.1 trillion.

More than a third of countries in that expanded group have seen their debt-to-GDP ratios surge above 70%, most of them in MENA, the report said. Any tightening of liquidity or rising interest rates will increase pressure on governments having to borrow more to fund programs, said Azour.

Fiscal support measures to combat the impact of the pandemic helped some economies weather severe economic downturns. But falling oil prices in a region heavily reliant on crude income meant budget deficits widened.

Higher prices have “improved the outlook this year, especially in terms of external accounts and also in terms of the fiscal side for oil-exporting countries,” Azour said.

The IMF estimates average deficits as a share of economic output last year reached nearly 12% for advanced economies, about 10% for emerging markets, and 5.5% for low-income economies.

More from the IMF:

- Economy of MENA region estimated to have shrunk 3.4% last year, from 5% contraction projected in October.

- Fiscal shortfalls widened to more than 10% of GDP in 2020, from 3.8% in the previous year.

- The Gulf Cooperation Council’s financing needs are set to reach $248 billion this year and next, about 27% of MENA’s total needs.

- Banks remained resilient, though bank-sovereign links have increased. “The full impact of the crisis on the sector is yet to be observed, given the continued policy support and regulatory forbearance measures.”

- Foods prices are expected to remain elevated this year, with the fund’s food price index seen rising about 14%.

©2021 Bloomberg L.P.