Jul 14, 2022

Morgan Stanley Strategists See European Profit Cuts Accelerating

, Bloomberg News

(Bloomberg) -- Analysts will speed up earnings outlook cuts of European companies amid a flurry of headwinds and regardless of how strong the second-quarter results will be, according to Morgan Stanley strategists.

“Unfortunately, the positive message from second-quarter results is largely irrelevant, given it is backward looking,” strategists led by Ross MacDonald wrote in a note. European earnings revisions have turned negative in the past few weeks and Morgan Stanley expects these downgrades to “accelerate going forward, as macro uncertainty prompts analysts to reduce future estimates irrespective of whether justified by company guidance or not.”

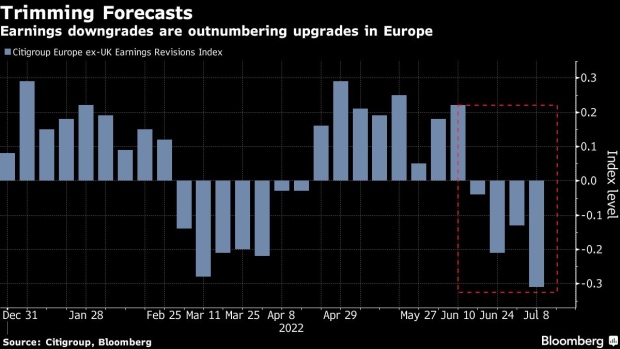

Investors are bracing for a challenging earnings season, which will provide insight into whether companies are able to overcome surging inflation, supply constraints and interest rate hikes. European ex-UK profit downgrades have been exceeding upgrades over the past four weeks, according to a Citigroup Inc. index.

Morgan Stanley strategists see risks for both European margins and top-line assumptions, saying that consensus earnings-per-share estimates remain too high at 15% growth for 2022 and 3% for 2023, versus Morgan Stanley’s outlook of 5% and 2% respectively.

“The combination of a sharply slowing economy and persistent high inflation suggests that EPS risks come from both weaker top-line momentum and building margin pressures,” they wrote.

Morgan Stanley analysts expect second-quarter European earnings to beat estimates, but are downbeat for the full year. They have a positive view on stocks including Airbus SE, British American Tobacco Plc and Capgemini SE going into earnings and a negative view on the likes of Abrdn Plc, Eurofins Scientific SE and Hargreaves Lansdown Plc.

©2022 Bloomberg L.P.