Jul 11, 2022

Musk’s Debt Bankers Would Avoid Steep Losses If Deal Falls Apart

, Bloomberg News

(Bloomberg) -- Banks are usually upset when large leveraged buyouts fall apart because of the hefty fees they generate. But Elon Musk’s decision to back out of a $44 billion bid for Twitter Inc. may mean dodging hundreds of millions of dollars in losses from underwriting the debt.

Credit markets have tumbled since banks first agreed to raise $13 billion to finance the deal in April. The riskiest piece of the debt package alone would have caused losses exceeding $300 million at current market levels, according to Bloomberg calculations.

When banks commit buyout debt, they provide temporary financing that’s replaced by high-yield bonds and leveraged loans. They agree to cap the cost of the new debt, which is sold to investors.

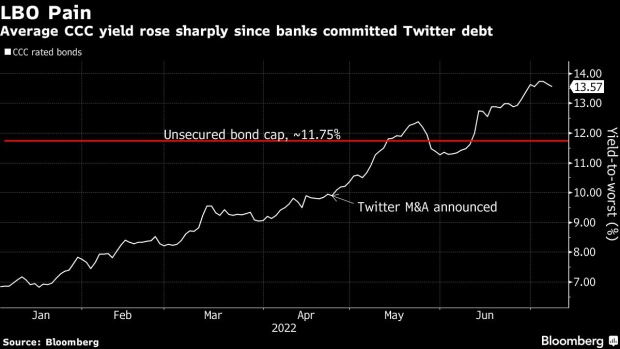

Banks had promised that the riskiest Twitter buyout debt -- $3 billion of unsecured bonds to be rated CCC, the lowest rung of junk -- would cost no more than about 11.75%. That compares to a market average of about 13.6% on comparably-rated bonds, up from 9.9% when the deal was announced, according to data compiled by Bloomberg.

If the debt yields more than 11.75%, banks eat into fees. They would incur outright losses if the rate exceeds 12.125%.

At a fixed 11.75% coupon, and assuming an eight-year maturity, banks selling the unsecured bonds today would have to offer a discounted price of about 85 cents on the dollar to reach an all-in yield of about 13.6%. That would result in a loss of more than $300 million, net of underwriting fees banks typically earn for selling unsecured debt.

The Twitter financing package -- one of the largest in recent memory -- also includes $6.5 billion of leveraged loans and $3 billion of secured junk bonds. Those types of debt have held up better than unsecured bonds -- though the loan market has dropped significantly -- and it’s unclear how much of a loss, if any, banks would take at current market levels.

Underwriting losses may be partly offset for Morgan Stanley, Bank of America Corp., and Barclays Plc, which would be expected to receive fees for providing M&A advisory services to Musk. Four other banks that only provided the debt -- MUFG Bank, Mizuho, BNP Paribas SA, and Societe Generale SA -- risk going deeply into the red if the deal goes ahead.

Representatives at Morgan Stanley, Bank of America, Barclays, MUFG, Mizuho, BNP Paribas and Societe Generale declined to comment.

The entire situation is in flux because Twitter’s board plans to sue to force Musk to complete the acquisition. If that happens and debt markets rally, banks may be able to fund the deal without losses.

Read more: Why Banks Face Billions in ‘Hung Debt’ as Deals Cool: QuickTake

Twitter isn’t the only LBO threat to banks. The biggest pain point is the upcoming $15 billion package helping to fund the buyout of Citrix Inc., signed in late January, which could leave banks on the hook for about $1 billion of losses.

Elsewhere in credit markets:

Americas

The founders of bankrupt crypto hedge fund Three Arrows Capital haven’t been cooperating in the firm’s liquidation process and their whereabouts were unknown as of Friday, according to court papers

- The asset-backed security market is set to kick into high gear after companies piled in with early marketing efforts late last week

- Two companies are selling bonds in the US investment-grade primary market following a strong US employment report on Friday

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

EMEA

Two issuers sold bonds in the primary, while the European Union’s 8 billion-euro ($8.06 billion) two part NGEU sale is likely to boost issuance volumes tomorrow.

- Corporate bond issuance is likely to shrink in coming months due to its high cost compared to bank loans

- Banks face big potential losses from about $80 billion in acquisition debt that they promised to raise to facilitate mergers and leveraged buyouts when financial conditions were better

- Rising interest rates and the end of easy money are causing pain for vast swathes of the economy, but for the real estate sector the drying up of central bank largesse threatens an entire way of doing business

- An index of real-estate bonds has lost more than 17% since the start of the year, the worst performing sector in the region’s high-rated debt market

Asia

China Evergrande Group suffered its first rejection from local creditors to extend a bond payment, a development that may result in a landmark onshore default and encourage investors to take a tougher stance against other developers battered by the nation’s property debt crisis.

- Meanwhile, Japanese megabank MUFG is marketing dollar debt in an otherwise subdued session Monday for such deals from Asia

- A risk-off mood hung over most markets in the region as concerns about the global economy dragged down raw materials including oil

- Japan was the exception after the ruling coalition expanded its majority in an upper house election

- Spreads on Asian investment-grade dollar bonds, which have tightened about 2bps over the last fortnight, were little changed Monday, according to a trader

©2022 Bloomberg L.P.