Jun 25, 2018

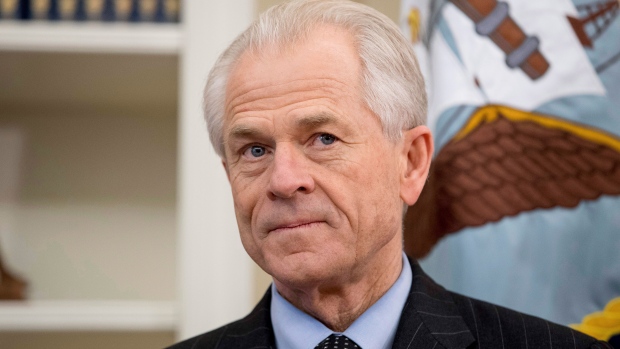

Navarro seeks to calm investor concern on Trump trade policy

, Bloomberg News

White House trade adviser Peter Navarro sought to ease investor concerns about U.S. trade policy, indicating that a Treasury Department report later this week on American restrictions on Chinese investments won’t be as damaging to growth as markets are anticipating.

“There’s no plans to impose investment restrictions on any countries that are interfering in any way with our country. This is not the plan,” he said in an interview on CNBC Monday with the Dow Jones Industrial Average down more than 400 points. “The whole idea that we’re putting investment restrictions on the world -- please discount that.”

“All we’re doing here with the president’s trade policy is trying to defend our technology when it may be threatened,” Navarro said.

Stocks pared losses after Navarro’s softening of the Trump administration’s trade rhetoric. The Dow Jones Industrial Average ended the day down 1.3 per cent, the ninth drop in the past 10 trading days.

Recent equity-market declines are an overreaction, Navarro said. “Things are bullish here in America,” he said, adding that U.S. economic growth is going to reach 4 per cent.

The Treasury Department is due to announce restrictions on Chinese investment in the U.S. by Friday. The action is part of the Trump administration’s responses to China’s alleged intellectual-property theft, as laid out in a report that followed an eight-month investigation by the Office of the U.S. Trade Representative.

Treasury Secretary Steven Mnuchin said in a tweet earlier Monday that the report would not be specific to China “but to all countries that are trying to steal our technology.”

Navarro seemed to contradict Mnuchin’s statement, saying that the Section 301 investigation was focused on China and that Treasury’s assessment due Friday “does not include any other countries.”

Navarro said markets should “let the process work” and President Donald Trump is “going to get good information this week on where the chess board stands and make decisions accordingly.”