Jul 19, 2023

Netflix shares decline after sales and forecast come up short

, Bloomberg News

Netflix’s stock to remain range-bound this year while it deals with open questions: Eric Jackson

Netflix Inc. shares declined as much as 6 per cent after sales missed Wall Street estimates and the company issued a third-quarter forecast that also fell short.

Second-quarter sales rose 2.7 per cent to US$8.19 billion, Netflix said Wednesday, coming in slightly below analysts’ projections. And the company’s forecast for revenue of US$8.52 billion in the current period was shy of Wall Street estimates that average US$8.67 billion. That is due partly to foreign exchange rates and to price cuts in some markets.

“While we’ve made steady progress this year, we have more work to do to reaccelerate our growth,” the company said.

Shares of Netflix fell as low as US$448.88 in extended trading. They were up 62 per cent this year through the close in New York.

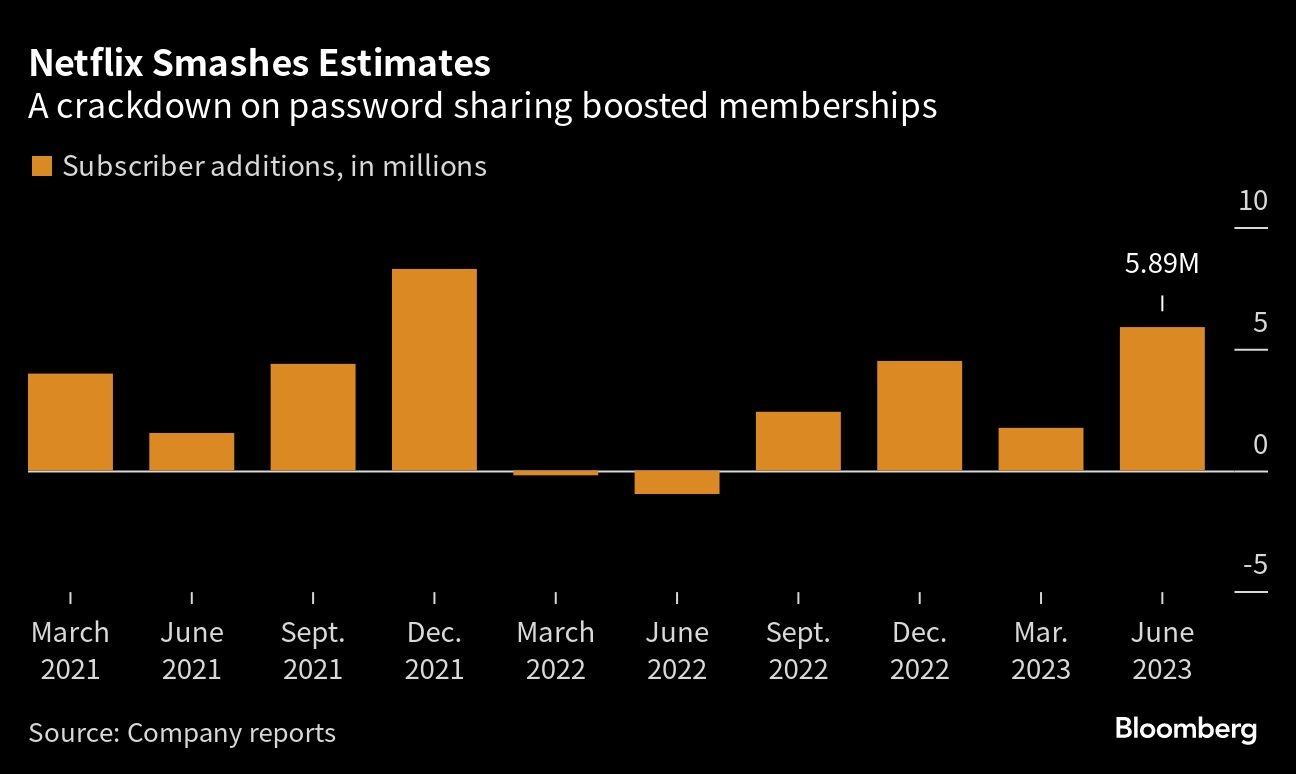

The shortfall overshadowed a solid quarter of subscriber growth. Netflix added 5.89 million customers in the second period, more than doubling Wall Street estimates after cracking down on people who share their passwords.

The results marked the company’s best second quarter since the depths of the pandemic three years ago and far surpassed Wall Street forecasts of 2.07 million new subscribers.

The numbers show the company’s twin strategies of cracking down on sharing and launching a new advertising-supported tier are paying off. Earlier Wednesday, Netflix eliminated its lowest-priced ad-free plan, pushing consumers toward a lower-priced, ad-backed service or a costlier commercial-free plan.

In May, the streaming leader started charging people in more than 100 countries to continue sharing their passwords, a key part of its plan to accelerate growth after a sluggish 2022. Viewers using someone else’s subscription can now either pay to keep sharing or set up their own account.

The plan has been controversial with users, and analysts weren’t sure how it would impact the company’s growth. Netflix had warned that it would see an uptick in cancellations at the start of the crackdown and that it would see more growth in the back half of this year.

But in recent weeks, third-party data indicated that Netflix was seeing a surge in customers.

The company said new sign-ups are already exceeding cancellations and that sales growth will accelerate in the months ahead, with third-quarter growth projected at 7.5 per cent.

Netflix finished the quarter with 238.4 million members, up 8 per cent from a year ago.

While analysts have raised concerns about losses from streaming at many of Netflix’s competitors, including Walt Disney Co. and Warner Bros. Discovery Inc., Netflix is delivering higher profit quarter after quarter. Second-quarter earnings, at US$3.29 a share, beat the US$2.85 a share average of analyst estimates.

“While streaming is intensely competitive, we’ve shown that with strong execution and focus, it can be a great business,” the company said in a letter to shareholders.

The company raised its 2023 forecast for free cash flow to US$5 billion, from at least US$3.5 billion previously, as a result of a strike by writers and actors, which has shuttered production and cut spending.

The password crackdown will provide a temporary boost in subscribers. Netflix had long said it didn’t care if people used someone else’s account. But that was when it was adding more than 25 million customers a year. Netflix lost customers in the first half of 2022, prompting a steep drop in the shares and leading to a selloff in other media stocks.