Dec 12, 2022

New Front in ECB’s Inflation Battle to Bring Bargaining on Rates

, Bloomberg News

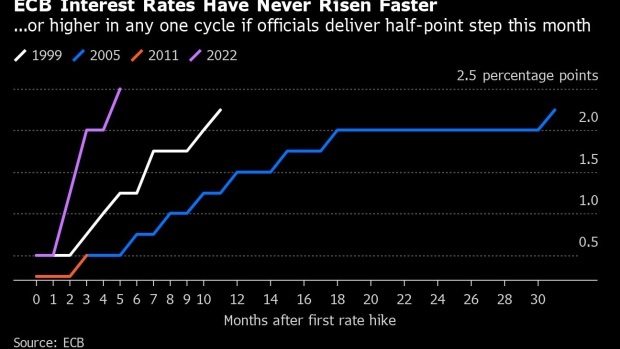

(Bloomberg) -- The opening of a new front in the European Central Bank’s fight with runaway inflation will bring with it bargaining over the path for interest rates — resulting in a potentially smaller hike this week.

Alongside its decision on borrowing costs, the ECB is set to announce how it plans to unwind €5 trillion ($5.3 trillion) of bonds purchased during past stimulus pushes, adding more bite to the 200 basis points of rate increases to date.

Hawks on the 25-member Governing Council are eager to commence the process, called quantitative tightening. Their dovish colleagues, who fret about an impending recession, may use that determination as leverage to secure more modest rate moves. Economists predict a half-point step on Thursday after 75 basis-point increments at each of the last two meetings.

It wouldn’t be the first such compromise. As recently as July, the ECB unveiled a bigger-than-expected rate increase while presenting a new tool to calm the bond markets of indebted euro-zone nations as monetary aid is withdrawn.

The stakes now are higher. While inflation may be peaking, the deposit rate, at 1.5%, is approaching levels that risk further damage to the fragile economy. What’s more, QT is uncharted territory for both the ECB and European markets.

“Lately, the more hawkish faction of the Governing Council has been less strident in seeking a harsher tightening,” said Birgit Henseler, a strategist at DZ Bank in Frankfurt. “In return for what’s likely to be a less aggressive rate hike, the policymakers may well decide to stop the full reinvestment of cash flows under the Asset Purchase Program with effect from March.”

Lithuania’s Gediminas Simkus and Latvia’s Martins Kazaks, two of this year’s most outspoken ECB hawks, have left the door open for a smaller rate move, hinting at a tradeoff between balance-sheet reduction and the pace of hikes.

If the range of instruments is broadened, “then perhaps the rate increase can step down at some point,” Kazaks said in November.

France’s Francois Villeroy de Galhau has said openly that he prefers a half-point increase. Chief Economist Philip Lane has signaled a similar view, saying “a lot has been done already” and the “starting point is different now.”

After December, economists surveyed by Bloomberg predict another 50 basis-point hike in February — taking the deposit rate to a 2.5% peak. They see the ECB starting to offload bonds under QT in the first quarter.

Exactly how that will happen isn’t entirely clear, beyond a preference by a broad majority of officials for allowing maturing debt to roll off, rather than implementing outright sales. President Christine Lagarde has pledged a “measured and predictable” approach.

But it’s the precise design of QT — particularly its timing and speed — where the room for conflict is largest. The experience of the Federal Reserve and the Bank of England offers only limited guidance as the ECB needs a strategy that will work across a bloc of 19 — soon to be 20 — divergent countries.

Despite a push by Bundesbank chief Joachim Nagel to fully halt reinvestments of maturing debt under the APP by March, caution appears to be the watchword.

Even his hawkish colleague Klaas Knot from the Netherlands, for instance, wants an “early but partial stop to reinvestments, to test the waters before calibrating the ultimate pace of the rolloff.”

Much will depend on how the economy withstands the winter energy squeeze. Fresh forecasts this week will offer pointers on how households and firms may cope. But the high uncertainty that persists may assuage even the toughest policymakers.

“Lots of criticism from the hawks was based on quantitative easing,” said Martin Wolburg, an economist at Generali Investments. “Embarking on QT will address some of their concerns. They’ll put more emphasis on this and adopt a more relaxed stance on rates.”

©2022 Bloomberg L.P.