Jan 28, 2021

New Zealand Inflation Seen Accelerating to RBNZ’s Target by June

, Bloomberg News

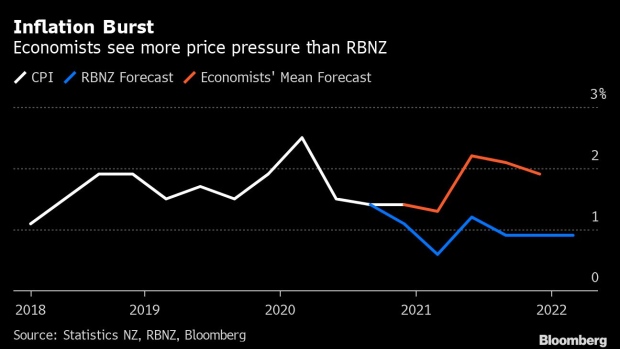

(Bloomberg) -- New Zealand inflation is expected to jump back to the central bank’s target much sooner than previously anticipated, further undermining the case for additional monetary easing.

Westpac New Zealand economists on Friday joined counterparts at Bank of New Zealand, ANZ and ASB in predicting an inflation rate of at least 2.1% by June. By contrast, the Reserve Bank in November said it didn’t expect to hit the midpoint of its 1-3% target band until the third quarter of 2023.

New Zealand’s surprisingly strong rebound from a lockdown-induced recession has seen investors dump bets on the RBNZ cutting the official cash rate into negative territory. A firmer price outlook is another reason for the RBNZ to hold fire on any further stimulus.

The annual inflation rate held steady at 1.4% in the fourth quarter, defying predictions it would soften to 1.1%.

Dominick Stephens, chief New Zealand economist at Westpac in Auckland, said global demand for commodities and consumer goods was rising at a time when supply was constrained by the coronavirus pandemic, resulting in price increases.

This phenomenon “has a little further to run” and “could culminate in 2.1% annual inflation around June of this year,” he said.

However, the inflation spike would prove to be a temporary as supply eventually met demand and inflation began to slow again.

“That will leave the RBNZ reasonably comfortable,” Stephens said. “There’s no need for them to cut the OCR further but this little spike in inflation won’t have them hiking either.”

The RBNZ next reviews its cash rate, currently at 0.25%, on Feb. 24.

©2021 Bloomberg L.P.