Apr 11, 2023

Norway Inflation Quicker Than Expected, Backing Rate Outlook

, Bloomberg News

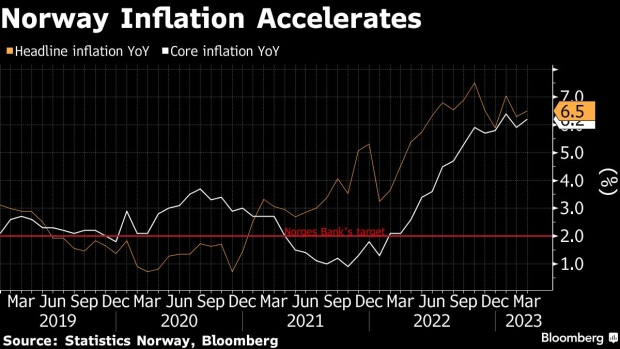

(Bloomberg) -- Norway’s inflation unexpectedly accelerated last month, in what’s likely to cement the central bank’s plan to raise interest rates by half a point in coming months.

Headline inflation rose year-on-year to 6.5% in March, boosted mainly by electricity prices, the statistics office said on Monday. That compares with a median projection of 6.1% by economists in a Bloomberg poll, while the central bank had forecast 6.0%. Core inflation, the measure followed by Norges Bank, was in line with projections.

The news is yet another unwelcome surprise for the energy-rich country’s authorities as the central bank and the government are both seeking to tighten their policies to prevent a price-wage spiral, while a weaker-than-forecast krone has fueled imported inflation. The data may add to speculation that policy makers could raise borrowing costs by a total of 75 basis points from 3% now.

“Given the continued high inflation and weak NOK, we are strongly convinced that Norges Bank will stick to their planned rate hike from the current 3% to 3.25% on May 4,” Nordea’s analysts Dane Cekov and Kjetil Olsen said in a note to clients. “We (still) expect a rate top at 3.75% during the summer.”

While the government has ordered probes on price formation in the groceries’ market, the central bank last month raised its outlook for peak benchmark interest rate to around 3.6%. Central bank Governor Ida Wolden Bache said last month she isn’t yet seeing a price-wage spiral in the Norwegian economy but added more krone weakness could call for faster rate increases.

The Norwegian currency, the worst performer in the G-10 group of major currencies this year, was largely unchanged after the report at 11.4405 versus the euro at 9:15 a.m. in Oslo.

Norway’s labor and housing markets have largely shrugged off the fallout from higher prices and growing credit costs, with the most solid prospects for a continued economic expansion among the Nordic nations, except for Iceland.

Core inflation accelerated to 6.2% last month, matching forecasts by both analysts and Norges Bank, while still remaining below an all-time high of 6.4% hit in January. The increases were led by clothing, durable goods and home textiles, the statistics office said.

“The price momentum is still too strong for Norges Bank back down from rate hikes anytime soon,” Swedbank’s Chief Economist Kjetil Martinsen, said in a note. “For fixed income markets, a hike in May and also June should be priced with a higher probability, although the banking issues in the US continue to add uncertainty on the future path of hikes.” He added the forward rate-agreement markets currently price in a peak policy rate in Norway of about 3.35%.

In Denmark, the inflation rate fell for a fifth month, pulled down by lower prices for electricity and natural gas, the country’s statistics office said on Tuesday. The consumer price inflation rate was 6.7% in March, down from 7.6% a month earlier and off a 10.1% peak in October.

--With assistance from Joel Rinneby, Ainhoa Goyeneche and Christian Wienberg.

(Updates with analysts comments from third paragraph.)

©2023 Bloomberg L.P.