Nov 16, 2018

Oil Demand for Cars Is Already Falling

, Bloomberg News

(Bloomberg Opinion) -- The International Energy Agency published its World Energy Outlook this week, its annual effort at revising assessments of future demand for and supply of fuels and electricity. There’s a familiar theme within it: The IEA expects more renewable-energy use in the future than it did in last year’s outlook, which was more than it forecast in the 2016 outlook. There’s also something noteworthy on transportation: The IEA is calling the top on oil demand from cars.

According to the report:

Oil use for cars peaks in the mid-2020s, but petrochemicals, trucks, planes and ships still keep overall oil demand on a rising trend. Improvements in fuel efficiency in the conventional car fleet avoid three-times more in potential demand than the 3 million barrels per day (mb/d) displaced by 300 million electric cars on the road in 2040.

It’s noteworthy when a long-term projection calls the top on demand for something as fundamental as a component of global oil demand. But demand for oil consumed for transportation is already waning in certain markets and segments.

One place is in buses. Electric buses will displace about 233,000 barrels of oil demand a day by the end of the year. Add in the much smaller displacement from electric cars, and there’s 279,000 barrels a day displaced — about as much oil as Greece consumes per day.

Another is Europe. As Bloomberg Intelligence’s Rob Barnett notes, the latest figures from Germany show demand for diesel fell 9 percent in the first half of the year. The influence of Green Party lawmakers will dent demand further.

Then there’s Italy, where demand for gasoline has fallen by nearly half since 2005.

Even if electric vehicles make up a very small part of the current displacement of oil demand, that will certainly grow. Bloomberg NEF expects twice as many electric vehicles on the road as the IEA does, and those vehicles will displace more than twice as much oil demand as the IEA expects.

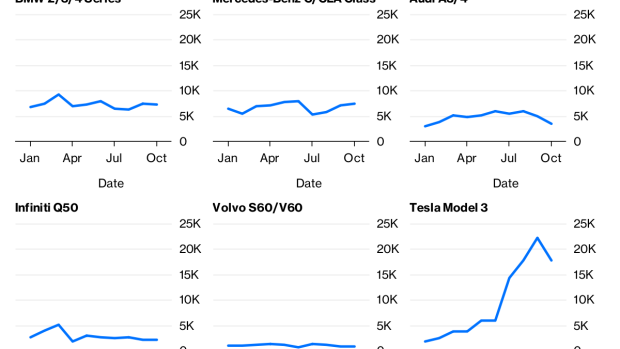

Automobiles are devices of culture and behavior, both of which can change quicker than a long-term energy-modeling exercise would suggest. You can see the latter in Tesla Model 3 sales in the U.S. this year: The Model 3 is now more popular than the entry-level luxury offerings of Audi, BMW and Mercedes-Benz combined.

Cars are devices of regulation, too, and nowhere is regulation’s force more apparent than in China. Starting in January, all major domestic and foreign manufacturers operating in the country must meet minimum requirements for electric, hybrid and fuel-cell vehicles. China is the world’s biggest auto market, and nudging its demand for electric vehicles even slightly higher could have significant impacts on oil demand. At the moment, most Chinese electric vehicles are confined to the domestic market and have “zero brand value outside of China,” per Macquarie Capital’s Janet Lewis. That probably won’t last forever, though, and if global buyers take to Chinese-made electric vehicles, it will mean more barrels of oil that aren’t needed for cars.

Weekend reading

- I counted only three American-made cars — and a package-delivery drone of uncertain make — in the mockup of builder JBG Smith’s plans for National Landing, Amazon’s Virginia headquarters location.

- Why did Chicago not win the bid to host (one of) Amazon’s two new headquarters? It’s a closed network.

- America really is a nation of suburbs.

- Over half of all U.S. households are headed by someone older than 50, and the nation’s housing stock is not prepared for a growing aging population.

- Ride-hailing company Lyft is rolling out an airline-style rewards program.

- French ride-hailing company BlaBlaCar plans to buy bus operator Ouibus, owned by government rail operator SCNF.

- Power generator AES Corp. says its business can withstand a warmer world and lays out its strategy in a detailed report.

- California wildfires are “a potentially chronic problem and a tangible cost of climate change” for utilities.

- A survey of 72 institutional investors with more than $500 billion in private equity allocation finds that almost 20 percent of investors have sustainable private fund managers, and 81 percent have some type of sustainability- or impact-investing mandate.

- A contrarian take on green finance from Russian investment bank Renaissance Capital, which says that the U.K., U.S. and other countries only endorsed environmental, social and governance goals once they got rich.

- A Japanese minister in charge of cybersecurity said “since the age of 25, I have instructed my employees and secretaries, so I don’t use computers myself.”

Get Sparklines delivered to your inbox. Sign up here. And subscribe to Bloomberg All Access and get much, much more. You’ll receive our unmatched global news coverage and two in-depth daily newsletters, the Bloomberg Open and the Bloomberg Close.

To contact the author of this story: Nathaniel Bullard at nbullard@bloomberg.net

To contact the editor responsible for this story: Brooke Sample at bsample1@bloomberg.net

My Bloomberg NEF colleagues have published a detailed comparison of the IEA’s forecast with their own New Energy Outlook to 2050.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Nathaniel Bullard is an energy analyst, covering technology and business model innovation and system-wide resource transitions.

©2018 Bloomberg L.P.