Jun 8, 2023

‘Old Economy’ Stocks Poised to Pick Up Slack When AI Mania Eases

, Bloomberg News

(Bloomberg) -- For all the frenzy around AI, there’s a quiet investor backlash building against the tech oligarchy’s recent stock market run.

T Rowe Price Group Inc., Bank of America Corp. and Citigroup Inc. are among those who reckon the hype around all things artificial intelligence is topping out. But they contend that’s not bad news for the market because so-called cyclicals — ‘old economy’ companies such as banking and mining — are primed for a rebound.

Such stocks have been elbowed out of the way in recent months by the stampede for AI-linked stocks such as Nvidia Corp. and Advanced Micro Devices Inc. With record investment flows, these stocks have led the Nasdaq 100 benchmark to its biggest ever outperformance against the Russell 2000 small-cap share index.

To illustrate the divergence, a $1000 investment made on January 1 on the Nasdaq would have earned a return of $330, while a similar amount placed on the Russell index would have earned — nothing.

Nonetheless, small caps are beginning to regain ground. This week’s rally in the Russell 2000 has surpassed moves in the Nasdaq by nearly 5% as a growing band of investors wager that beaten-down cyclicals will reap greater future reward than frothy tech. That’s because they believe expectations of US recession and interest rate cuts — a powerful driver for tech stocks — are way overdone.

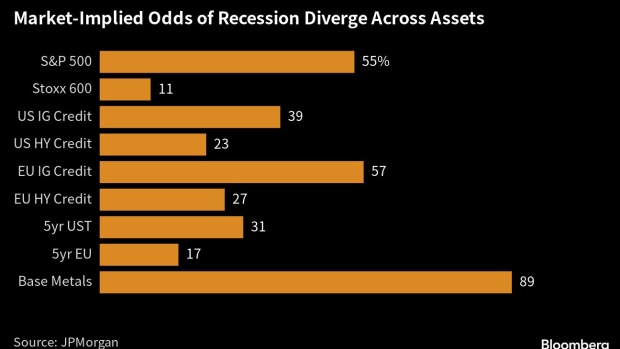

Sebastien Page, chief investment officer at $1.35 trillion asset manager T Rowe Price has been snapping up small-cap stocks on a view that markets are overestimating recession risks.

“Right now, the pulse is more toward a soft landing,” Page said in an interview. “These assets look really cheap and this is an opportunity to lean in when no one else is ready yet.”

Some are also skeptical a rally built around megacap stocks can endure. The S&P 500 is teetering on bull market territory but May saw more stocks hit 52-week lows than 52-week highs. Market narrowness is at extremes and the five biggest stocks in the index, notably all of them tech names, now make up nearly a quarter of the index by market cap.

“It’s an unbelievably concentrated market rally,” Page said. “A handful of stocks are up and the rest of the market is basically flat.”

Some long-standing tech fans are also lightening up on positions. Edmond de Rothschild Asset Management has trimmed its Nvidia overweight, held at least since 2020, citing “lofty” valuations across AI tech.

Cyclicals Setback

Cyclical bank and mining shares enjoyed a bumper 2022, benefiting from higher interest rates and post-Covid normalization. But as US banking turbulence in March stoked fears of a severe downturn, investors rushed for so-called growth shares, which benefit more when borrowing costs fall.

But many economists now expect a recession to be shallow and short-lived — Bank of America Corp., for instance, sees a 0.8% peak-to-trough GDP decline and Savita Subramanian, its head of US equity strategy, says the US debt ceiling resolution, alongside a tight jobs market set the stage for “a less dire recession.”

She expects cyclicals to lead markets higher from here, rebounding off the biggest positioning underweight since 2008.

Similarly, a Citigroup Inc. team led by Scott Chronert is urging clients to allocate sidelined cash to cyclicals, predicting “cyclicals within the S&P 500 will gain market cap share at the expense of growth.”

Chronert’s recommendation is partly based on the valuation gap, with the Nasdaq 100 trading about 30 times forward earnings, versus 20 for S&P 500 cyclicals. He too expects a mild downturn, with less “shock effect” than previous episodes, given defensive positioning across much of the market.

AI Tide

Despite his bullish view on cyclicals, Chronert acknowledges the difficulty of fighting the AI tailwind. So he advises those already invested in tech to hold onto positions, while warning the rally is too far gone for new investors to join.

“Momentum remains strong, but difficult to chase,” he added.

Meanwhile, economic data has been mixed. Key metrics are beating expectations, a gauge of economic surprises shows, as labor and housing markets slow but only gradually. But inflation isn’t cooling as quickly as hoped, while a key recession indicator, the Treasury yield curve, continues to flash warnings.

That poses a dilemma for anyone looking to position for a cyclicals rebound, all the more so if they were burned earlier in 2023 by the market’s sudden pivot to tech.

Natixis Investment Managers were among those caught holding an overweight on financials and value stocks earlier this year. Despite doubts over the AI-fueled rally, they are hesitant about committing more money to cyclicals.

“Different things keep becoming the flavor of the month and there is very little trend,” said James Beaumont, head of multi-asset portfolio management in an interview. “We haven’t put our chips on the table yet.”

©2023 Bloomberg L.P.