Apr 3, 2023

OPEC+ Wants to Make Oil Speculators Think Twice With Shock Cut

, Bloomberg News

(Bloomberg) -- The surprise OPEC+ production cut was aimed squarely at one audience: speculators betting that oil prices would fall.

It’s a return to the tactic first used by Saudi Energy Minister Prince Abdulaziz bin Salman in 2020, when he famously said he wants “the guys in the trading floors to be as jumpy as possible” and vowed that “whoever gambles on this market will be ouching like hell.”

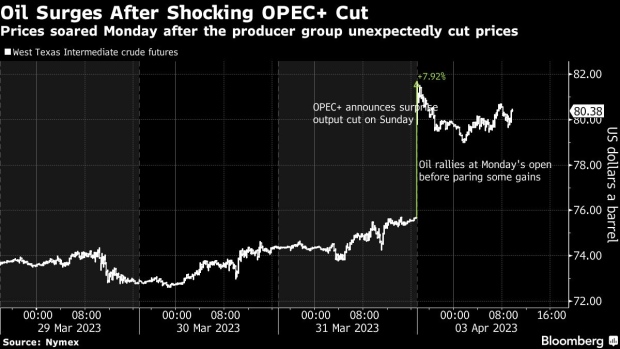

The new attack on short sellers was successful. Markets were wrong-footed and oil futures surged as much as 8%, repricing assets from equities to bonds. Yet OPEC+ also caught consumers and the global economy in the crossfire, spurring concerns about inflation and prompting bets on further interest rate hikes.

The Organization of Petroleum Exporting Countries and its allies began to see the need for a change in oil policy on March 20, according to people familiar with the matter, when Brent crude slid to a 15-month low near $70 a barrel as a banking crisis threatened to hobble the economy. The Saudis reflected that short sellers were due a reminder of the pain OPEC+ can still inflict on them, the people said.

The decision to hold back more than 1 million barrels of oil from the market was finalized in just a few days — and in a very tight circle. Some delegates said they found out just a day or two before the announcement. Two officials said they were completely blindsided by the decision.

The impact was all the greater because, in the buildup to an OPEC+ committee meeting scheduled for Monday, Prince Abdulaziz had repeatedly said the group would hold output steady for the entire year to keep markets stable.

Yet the announcement on Sunday in the European afternoon, with markets closed, was chosen for maximum impact, the people said. Sure enough, Brent jumped more than $6 a barrel when Asia woke up, the biggest move in more than a year.

READ: Yields Climb as OPEC+ Move Emboldens Fed-Hike Bets: Markets Wrap

Explaining the decision, delegates pointed to market data on the build-up in short-selling.

As prices slumped with the banking crisis in late March, speculators piled up bearish bets on US crude to the highest in four years and reduced bullish positions to the lowest in more than a decade, according to figures from the CFTC.

The financial fears abated toward the end of the month and those short positions were dialed back, but by that point the Saudis were feeling nervous, the people said. The hastily brokered takeover of Credit Suisse Group AG had sparked fears that financial contagion could damage the global economy.

As the kingdom grew more concerned about the strength of oil demand, evidence emerged that supply was more than ample, the people said. In late March, a key export pipeline from Iraq was halted because of a legal spat between the Kurdish regional government and Baghdad, knocking about 400,000 barrels a day off global supply. Yet crude rose just 4%, strengthening the view that bearish speculators held sway over the market, said one person.

“The market had become a playing field for these shorts” and OPEC+ wanted to drive them out, Amrita Sen, director of research at Energy Aspects Ltd., said in a Bloomberg television interview. The producers group is saying “take us on, but at your own peril.”

The OPEC+ fight with short-sellers also has political implications. It brings most of the group into alignment with Russia, which kicked off the unilateral production cuts in February with a 500,000 barrel-a-day reduction in retaliation for international sanctions.

Those curbs haven’t yet fully materialized and their positive impact on prices had been erased by the banking crisis. Now, with OPEC+ members joining in, the oil revenue that feeds the Kremlin’s war machine will be bolstered.

The Saudis also had to weigh how the decision would affect its relationship with Washington, which has been strained by the kingdom’s repeated refusal to heed American requests for more oil. If the production cuts bring $100 crude back into play, with everything that would mean for high inflation and rising interest rates, US consumers and the White House could join the short sellers in “ouching like hell.”

READ: Biden Has Limited Options to Respond to OPEC+’s Oil Cut

--With assistance from Devika Krishna Kumar and Ben Bartenstein.

©2023 Bloomberg L.P.