Sep 22, 2022

Operation Twist to Help Bank Indonesia Quicken Rate Hike Impact

, Bloomberg News

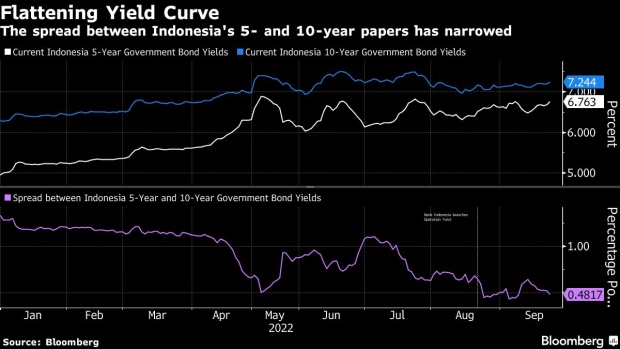

(Bloomberg) -- Bank Indonesia will continue with its “Operation Twist”-style bond intervention to hasten the transmission of its monetary policy in a market awash with cash.

The central bank’s move to sell short-dated government bonds has successfully pushed yields to rise in line with increases in the benchmark interest rate, Governor Perry Warjiyo said on Thursday. Purchases of longer-tenor debt has also kept long-term borrowing costs manageable, he added.

“During normal times when we adjust the interest rate, the yield would also adjust, but when liquidity is ample it becomes divergent,” he said during a conference call with investors. Bank Indonesia holds over 25% of outstanding government bonds as of Sept. 21.

Policy rate changes take roughly four quarters to work their way through the economy, as ample liquidity keeps bank rates declining, Warjiyo added.

Bank Indonesia has resorted to an array of tools to underpin the rupiah and get inflation under control, including a bigger-than-expected 50-basis point rate hike on Thursday. It’s raised the reserve requirement for lenders to a record-high 9%, from 3.5% at the start of the year, to pull 269.3 trillion rupiah ($18 billion) from the banking system so far. The central bank will also strengthen its monetary operations to adjust the structure of money market rates.

(Updates with Bank Indonesia ownership of government bonds in third paragraph)

©2022 Bloomberg L.P.