Apr 27, 2021

OSFI signals no plans to loosen bank buyback, dividend restrictions in near term

, BNN Bloomberg

McCreath: Canadian banks making more loans

Canada’s banking watchdog doesn’t seem too keen on lifting restrictions on share buybacks and dividend hikes at the big banks any time soon.

In a speech Tuesday, Office of the Superintendent of Financial Institutions (OSFI) Assistant Superintendent Ben Gully said the banking regulator was still monitoring the impact of the third wave of the pandemic and plans to leave the measures in place until the concerns subside.

“OSFI is acting prudently in the context of continued uncertainty related to COVID-19, and will maintain the restrictions until they are no longer fit for purpose and once we have greater clarity on the path forward out of the pandemic,” he said.

“Our review of our expectations related to capital distributions remains ongoing, and any decisions related to the unwinding of these restrictions will be communicated quickly, transparently and well in advance.”

OSFI implemented the measures in March 2020, which banned share repurchases, payout hikes and increases to executive compensation to ensure the banks had sufficient liquidity at hand for lending. Since those measures were put in place, the Canadian economy has fared better than expected, which led to the banks cutting the amount of cash set aside for potentially sour loans.

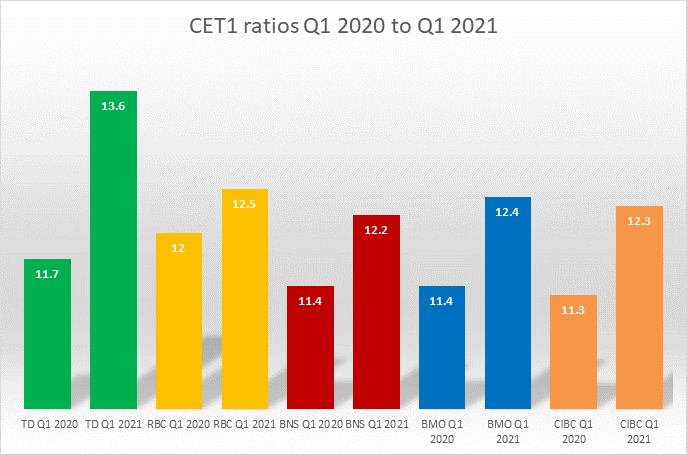

Along with those lower loan loss provisions, the common equity tier one ratio (CET1) – a key financial buffer banks must keep in place in case of severe economic stress – at all big five banks have ballooned as cash otherwise earmarked for dividends, buybacks and potentially acquisitions piles up.

That appetite to deploy excess cash on the balance sheet has been on full display among the nation’s top banking executives. Speaking at the RBC Capital Markets’ Canadian Bank CEO Conference in January, Scotiabank Chief Executive Officer Brian Porter said he was ready to swing into action the moment OSFI loosens the restrictions.

“When the regulator gives us the green flag to do that, the next day we’ll be out buying stock back,” Porter said. “We think our stock is inexpensive on any historical or current valuation metric.”