Jan 31, 2023

Pakistan’s Rupee Rises From Record Low as IMF Set to Start Talks

, Bloomberg News

(Bloomberg) -- Pakistan’s rupee advanced from a record low as the International Monetary Fund team starts negotiations over the resumption of its $6.5 billion bailout.

The rupee climbed to 267.89 per dollar at close on Tuesday, after sliding to an unprecedented 270 on Monday, according to the foreign—exchange desk at Arif Habib Ltd. The benchmark stock index climbed 2%, snapping a two-day loss.

Optimism the nation may be at the brink of securing funds from the IMF is growing after Prime Minister Shehbaz Sharif took bold steps, including loosening its grip on the currency and raising fuel prices. A team from the Washington-based multilateral lender arrived Monday for a review after months of delay in the next loan tranche.

Read: Pakistan Takes Hard Steps in Efforts to Secure IMF Bailout Plan

“The Pakistani rupee will probably stabilize around these levels until we get more information from the IMF visit,” said Johnny Chen, fund manager at William Blair Investment in Singapore.

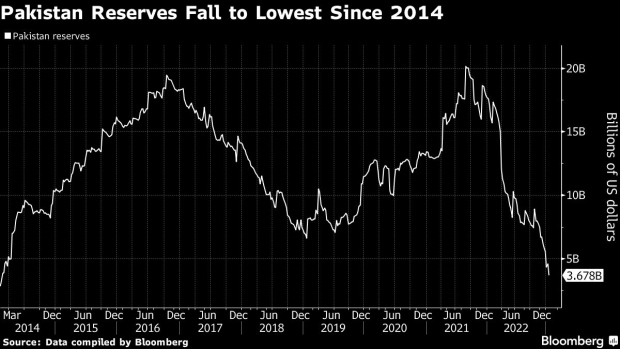

The rupee slid almost 15% this month after money exchange companies abolished the limit on the dollar-rupee rate in the open market to curb the black market, where the greenback was being sold at about 10% above advertised rates. Pakistan is spiraling deeper into crisis amid a shortage of dollars and accelerating inflation, with reserves falling to a nine-year low.

Pakistan will need to stop the erosion of its reserves and see improved inflows to ease the pressure on the rupee, according to Avanti Save, analyst at Barclays Plc. A deal with the IMF is expected to unlock more funds with about $10 billion in assistance committed for rehabilitation after floods inundated a third of the country. The United Arab Emirates also agreed to a new $1 billion loan and Saudi Arabia is considering a $2 billion loan.

Finance Minister Ishaq Dar is facing the difficult task of convincing the IMF that the country is ready to implement other tough measures, including raising taxes and gas prices. Sharif has said his coalition government is determined to complete the bailout plan after a delay in implementing key decisions, even though it means paying a political cost just months away from national elections.

“The IMF visit provides a temporary boost to sentiment at best,” said Hasnain Malik, a strategist at Tellimer Markets Inc. in Dubai. “Chronically low foreign reserves, high short-term external debt, high inflation, a growth model reliant on imports — all these suggest that efforts to manage the exchange rate are going to prove futile and counter-productive.”

(Updates with talks starting in first paragraph, closing prices in second and analysis in sixth)

©2023 Bloomberg L.P.