Apr 29, 2019

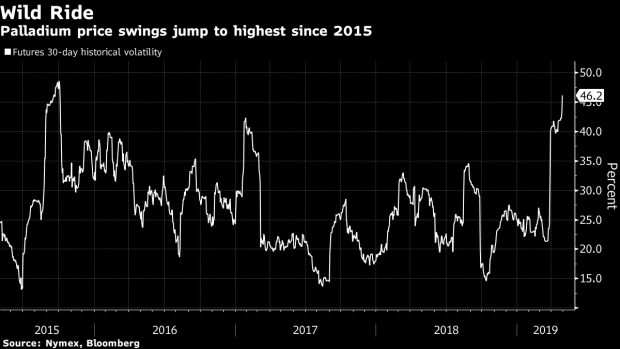

Palladium Sees Wildest Price Swings Since 2015

, Bloomberg News

(Bloomberg) -- Palladium futures tumbled, spurring the wildest price swings since late 2015 as investors turn sour on the precious metal.

The commodity used mostly in auto catalysts has been a profitable trade as supply shortages boosted prices of near-term contracts. That gave investors the incentive to sell futures closer to delivery and buy those that are further along the curve as producers struggle to meet demand from carmakers. That incentive is disappearing as supply concerns ease.

Palladium futures for delivery in June are now trading at a $5.10 discount to September futures, meaning it’s no longer profitable to roll the contract. That’s the first time the spread between the most-active contract and the one expiring three months later turned negative since April 2017. The cost to borrow the metal has tumbled this year.

“People who have done very well long material and lending it have seen margins compress,” Tai Wong, the head of base and precious metals derivatives trading at BMO Capital Markets in New York, said in an email. “The drastic supply shortage seen early in the year has eased significantly.”

--With assistance from Marvin G. Perez.

To contact the reporter on this story: Luzi Ann Javier in New York at ljavier@bloomberg.net

To contact the editors responsible for this story: Luzi Ann Javier at ljavier@bloomberg.net, Joe Richter

©2019 Bloomberg L.P.