Sep 28, 2022

Pantera Seeking $1.25 Billion for Second Blockchain Fund

, Bloomberg News

(Bloomberg) -- Pantera Capital plans to raise $1.25 billion for its second blockchain fund, tapping into growing appetite for digital assets among institutional investors even as prices swoon, founder Dan Morehead said.

Morehead aims to close the fund, which will invest in equity as well as digital tokens, by May, he said in an interview Wednesday at a conference in Singapore. He’s also looking to buy additional shares in some companies Pantera already owns, after valuations dropped.

“We want to provide liquidity for people that are kind of giving up because we’re still very bullish for the next 10 or 20 years,” Morehead said.

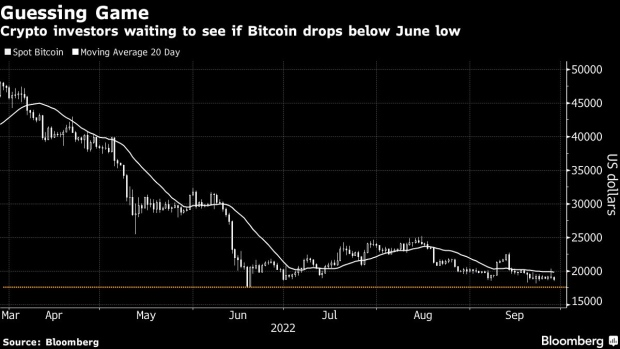

Morehead is ramping up investments after a collapse in prices that saw a major crypto project implode, several companies go bankrupt and a raft of CEOs resigning. Bitcoin is stuck trading below $20,000, pressured along with equities and bonds by monetary tightening by central banks from the US to New Zealand.

Read More: Crypto Leadership Upheaval Gives Fresh Jolt to Industry

“Unfortunately, crypto pricing has become correlated with risk assets, which I honestly don’t think has to be true,” Morehead said. “My hope is that soon crypto will decouple from the macro markets.”

(Updates with detail on fund’s strategy in second paragraph.)

©2022 Bloomberg L.P.