Dec 8, 2017

Personal Investor: TFSA total contribution room increases another $5,500 in 2018

By Dale Jackson

Canadian adults can contribute another $5,500 to their tax free savings accounts in 2018.

For the 10 per cent of TFSA holders who regularly contribute the maximum amount that might be disappointing considering the former Conservative government capped the allowable amount at $10,000 before the Liberals pulled it back.

For the 90 per cent of TFSA holders who don’t max out their TFSAs, it’s more opportunity to invest in just about anything – stocks, bonds, mutual funds, ETFs, and even options. Gains on those investments are never taxed and funds can be withdrawn at any time.

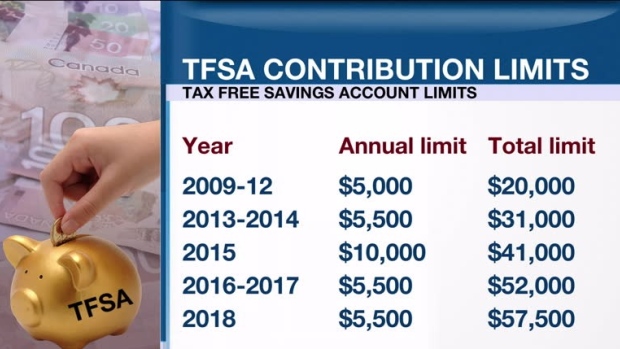

The total contribution limit since the TFSA was launched in 2009 will be $57,500 in the new year. If you turned 18 after 2009 contribution space has been accumulating from that year forward.

Here’s a chart of how TFSA contribution room has accumulated:

If you make withdrawals, you can regain the contribution space in the following calendar year. All that money coming and going might make it difficult to keep track and over-contributions could result in a penalty.

To find your contribution allowance, check your 2016 tax return statement from the Canada Revenue Agency or your personal CRA account.

One important note: the CRA only tracks TFSA contributions up to the preceding calendar year, so contributions will only be included up to the end of 2016. That means 2017 contributions are not included, and you must add them yourself.