Sep 27, 2023

Peru Grapples With Red Tape That’s Burying Giant Copper Projects

, Bloomberg News

(Bloomberg) -- If political turmoil and social unrest were the hot topics at Peru’s top mining event last year, this year it’s red tape.

While community opposition continues to weigh on the industry, executives at the Perumin show this week appeared more focused on the role of cumbersome permitting in holding back an estimated $57 billion project pipeline.

Read More: Peru Is Approaching Peak Copper as New Mines Stall

Frustrations with bureaucracy that can take years to navigate and involve multiple state agencies were expressed by presenters and attendees alike at an event held in Arequipa, a picturesque yet bustling city surrounded by giant copper deposits.

That’s why a commitment delivered by Prime Minister Alberto Otarola to move forward with streamlining efforts was cheered so loudly. Otarola announced plans to set up a digital one-stop shop to help companies navigate the system, as well as helping free up $11 billion in key projects awaiting permitting.

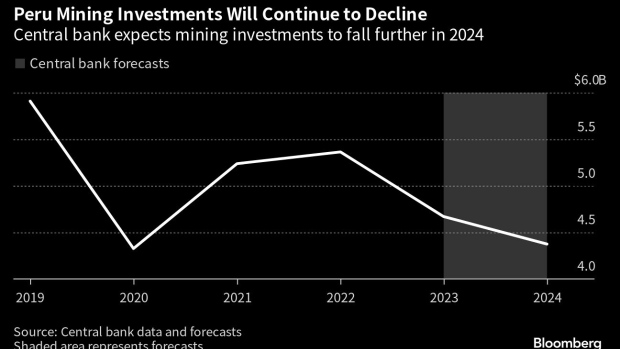

There’s a lot at stake, including Peru’s status as the world’s No. 2 copper supplier and spending that would help reignite economic growth. Along with winning over local communities, reducing bureaucracy is seen as a key to reversing a drop in mining investment that the central bank estimates at 18% this year and 8% in 2024.

“It’s not easy anywhere, but here we have complicated things to excess,” said Roque Benavides, the outspoken chairman of Peru’s top publicly traded precious-metals producer, Buenaventura. “The good news is that we’re listening to voices that want to simplify this.”

Benavides has plenty of experience dealing with red tape. His company has been working on the San Gabriel gold and silver deposit since the 1990s. The $500 million project is scheduled to enter into production by the end of 2024 or early 2025. But with more efficient permitting, it could have been up and running a decade ago, he said.

Another example came out this week at the conference, with Hochschild Mining Plc saying it will have to halt a Peruvian mine in the the fourth quarter due to pending permits.

Officials at Southern Copper Corp. and Antamina, co-owned by BHP Group, Glencore Plc and Teck Resources Ltd. also expressed frustration. An industry-funded study released this week said Peru had lost $32 billion in tax revenue due to social conflict and delayed projects.

To be sure, the industry is curbing its enthusiasm until the government’s plans become a reality. As Southern Copper’s Chief Financial Officer Raul Jacob said: “We’re seeing a better environment, but we need to see results.”

Still, the signs are positive.

“I didn’t vote for this government,” Benavides said in an interview at Perumin. “But I have to recognize that the messages are on the right path.”

©2023 Bloomberg L.P.