Jul 21, 2022

Philadelphia Fed Factory Outlook Falls to Lowest Since 1979

, Bloomberg News

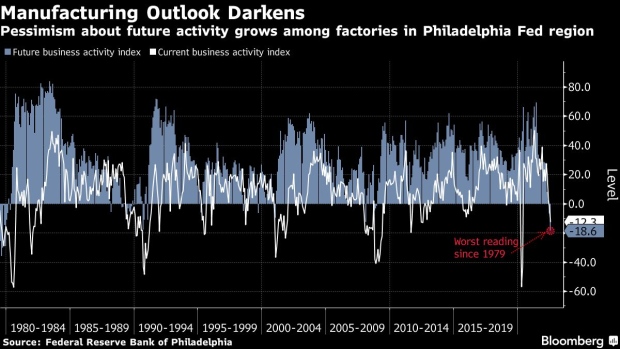

(Bloomberg) -- Philadelphia-area manufacturers’ outlook for business conditions slumped this month to the lowest level since 1979 as gauges of future new orders and planned capital expenditures both deteriorated.

Federal Reserve Bank of Philadelphia data on Thursday showed a measure of business conditions six months from now slid nearly 12 points to minus 18.6. The index of manufacturers’ current assessment dropped 9 points to minus 12.3, worse than all estimates in a Bloomberg survey of economists.

The Fed bank’s future index of new orders decreased 5 points to minus 12.4, also the weakest since 1979, with about one-third of manufacturers anticipating declines six months from now. The figures highlight growing anxiety about demand and the economy’s prospects amid widespread inflation and higher borrowing costs.

Separate data Thursday showed the Conference Board’s index of leading economic indicators dropped 0.8% in June, the steepest slide since April 2020 during the height of the pandemic.

“Amid high inflation and rapidly tightening monetary policy, the Conference Board expects economic growth will continue to cool throughout 2022,” Ataman Ozyildirim, senior director of economic research at the Conference Board, said in a statement. “A US recession around the end of this year and early next is now likely.”

Increased pessimism about the economy is prompting firms to reconsider capital spending plans. The Philadelphia Fed’s index of future capital expenditures slipped to 4.4 in July from 11.7 a month earlier.

©2022 Bloomberg L.P.