Sep 11, 2023

Popeyes Overhauls Its Kitchens to Win the Chicken Sandwich Wars

, Bloomberg News

(Bloomberg) -- The kitchens that served up Popeyes’ internet-breaking fried chicken sandwich are getting ripped up.

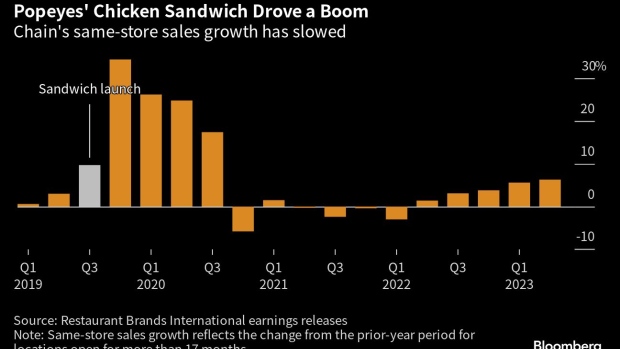

Those kitchens haven’t changed in at least a decade, largely because many at Popeyes were afraid of jeopardizing food quality. But by last year, it was clear a fix was needed. The chicken-sandwich boom had faded, and many guests who’d gone out of their way to try the hit product weren’t returning. Some complained that orders were slow and often wrong.

Sami Siddiqui, the brand’s president for the US and Canada since late 2020, asked franchisees what would be possible if the food were hot and perfect every time.

“Well, then we’d be Chick-fil-A,” was their response, he said, referring to the biggest-selling chicken chain in the US.

So Popeyes began an overhaul to create intuitive workstations, add automatic batter makers and even redesign boxes to make them easier to close. It’s part of a multiyear effort to boost growth and profitability that includes a broader menu — ghost pepper wings, anyone? — and a push to open new restaurants. At fewer than 4,300 locations worldwide, the chicken chain has about one-tenth of McDonald’s footprint.

The chain also needs to defend its turf. Fried chicken sandwiches became the second-most-added item to fast-food menus in 2022 after breakfast burritos, according to Datassential, and rivals including Chick-fil-A, Wingstop and Bojangles are building more stores.

Popeyes was founded as a single fried chicken restaurant in 1972 in Louisiana; three decades later annual sales crossed the $1 billion mark. In 2017 the chain was sold for $1.8 billion to Restaurants Brands International Inc., which also owns Burger King, Tim Hortons and Firehouse Subs.

Popeyes, until then known mostly in a few pockets of the US, broke through in August 2019 when it tweeted that it was now selling fried chicken on a brioche bun. Chick-fil-A responded that it had “the original,” to which Popeyes responded “... y’all good?”

More than 72,000 reposts followed. People stood in line for hours to try the chicken sandwich. Popeyes expected locations to sell about 60 each day; some ended up churning out 1,000. The sandwich sold out in two weeks. Because Popeyes couldn’t get enough of the small birds used for the recipe, it didn’t return until November.

“We had no idea it would do what it did,” said Amy Alarcon, Popeyes’ head of culinary innovation. “We had like one supplier for the bread. We had maybe two poultry plants set up to make the fillets the way we wanted them to.”

Then, in 2021, the pandemic made it again hard to fill orders due to supply-chain disruptions and a scarcity of workers, which hit Popeyes harder than burger chains since its chicken is hand-battered and breaded. Meanwhile, competitors, including KFC, launched their own new fried chicken sandwiches.

Through consumer panels and store visits, Siddiqui and his team discovered that Popeyes orders weren’t always right and that many potential guests had never seen a location. The average customer in the US only stopped by three times a year, far behind the 18 or so visits paid to McDonald’s, he said. On average, diners had to drive 10 to 12 minutes to get to a Popeyes, which Siddiqui has called “too far.”

“We’re hearing these people talk about Popeyes like a special treat,” Siddiqui said in an interview at Restaurant Brands’ Miami offices. In fast food, “you want it to be an everyday occasion.”

Part of the solution was obvious: open more restaurants. Achieving perfect orders every time was more complicated. As Siddiqui toured kitchens, he noticed many had the sandwich prep area in the back or off to the side. This made orders harder to put together and deliver quickly to the counter or drive-thru.

New Kitchen Plan

At Restaurant Brands’ Miami offices, operations geeks built a mock-up kitchen with five sequentially arranged modules with all the necessary tools and ingredients. Mini printers spit out stickers to attach to bags or boxes with the order’s details — classic chicken sandwich, no pickles, extra mayo. After going to a “landing zone” for a final check, the order’s “ready” notification is fired.

This type of kitchen is already common in the fast-food world, including at sister brand Burger King. Popeyes is testing the improved setup in four locations, and it’s planning to extend the pilot to 30 by year-end. The idea is to eventually implement it in new stores, and details on whether franchisees will foot the bills or the chain will provide support are still being sorted out.

Other changes are coming sooner. Popeyes is automating the multistep process required to make the frying batter, one that Siddiqui estimates only 20% of restaurants get right. It’s also introducing predictive software that tells cook what to make and when, to avoid telling customers they’ll have to wait 12 minutes for a new batch.

More efficient kitchens are key to the goal of boosting restaurant-level profits to $300,000 on average by the end of 2025 from $210,000 last year. That, in turn, is crucial for convincing franchisees to build more stores.

Popeyes opened a record number of locations in 2021 and 2022, said Jourdan Daleo, who leads franchising at Popeyes, and earlier this year signed a deal for 1,700 restaurants in China over the next 10 years.

Menus are also being scrutinized. The chain has a new non-breaded blackened chicken sandwich, with 20% fewer calories than the original version, which might be more appealing as a recurring lunch alternative. Popeyes has also jumped into wings, with a sweet and spicy option becoming its best-selling launch since the chicken sandwich, the company said.

Yet the biggest challenge is persuading franchisees that the overhaul will yield long-term benefits and it’s worth investing in, said Joshua Long, an analyst at Stephens. He added that Popeyes also needs to make sure the improvements work at scale, and not just in a lab or test.

If Siddiqui and his team pull it off, smoother operations could give Popeyes a big boost, according to Bloomberg Intelligence’s Michael Halen.

“It’s not the sexy thing to talk about, but it’s critically important,” he said. “You want to make sure that the food is getting to the customer hot. Improved customer satisfaction, speed of service — all of those things drive repeat purchases.”

©2023 Bloomberg L.P.