Feb 4, 2021

Pot-investment firm Nabis' 9,500% rally in peril as trades canceled

, Bloomberg News

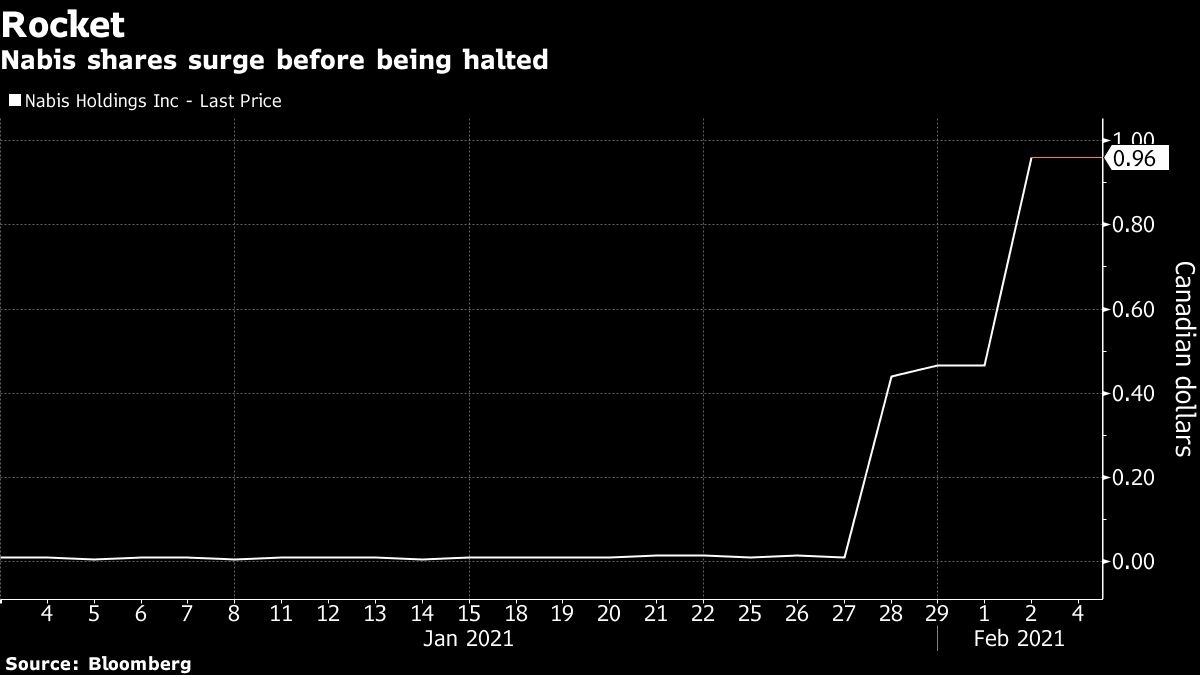

Nabis Holdings sees 9,500% rally cancelled as regulators look to protect market integrity

Micro-cap Nabis Holdings Inc. surged from a penny to nearly a dollar over the course of a week before the stock was halted. Now a Canadian regulator says it will nix all those trades.

The Investment Industry Regulatory Organization of Canada said all trades between Jan. 27 and Feb. 2 would be canceled. Short-selling was also ruled ineligible.

“IIROC has made this designation in the interest of maintaining a fair and orderly market based on the fails relative to the number of shares outstanding,” according to a separate statement on short selling.

IIROC and Nabis didn’t immediately respond to requests for comment. Nabis is a Canadian investment company focused on the cannabis sector, according to its website.

Canadian-focused cannabis stocks have been on a tear, with the Horizons Marijuana Life Sciences Index ETF up 73 per cent this year.

Nabis’s market value sits at $3.6 million after its surge and it has about 3.7 million shares outstanding. The company completed a recapitalization last month under Canada’s bankruptcy act, and issued 3.7 million new shares along with some new unsecured notes, according to a statement.

Separately, Nabis said Tuesday that one of its companies, Perpetual Healthcare Inc., got a dual license in Arizona to sell cannabis products to consumers as well as medical clients, while also settling a previously disclosed lawsuit.

Track the ongoing growth of the Canadian recreational cannabis industry here, and subscribe to our Cannabis Canada newsletter for the latest news delivered directly to your inbox every week.