Aug 6, 2023

Pound’s Glory Days Are Over as Bets on Ever-Higher Rates Fade

, Bloomberg News

(Bloomberg) -- The pound’s unexpected rally this year may have finally run out of steam as the Bank of England moves closer to wrapping up its tightening cycle.

Analysts and investors at firms including BNP Paribas SA, NatWest Markets Plc and State Street forecast officials will deliver just one more interest-rate hike, compared with market expectations for two more. They’re all bearish on the pound.

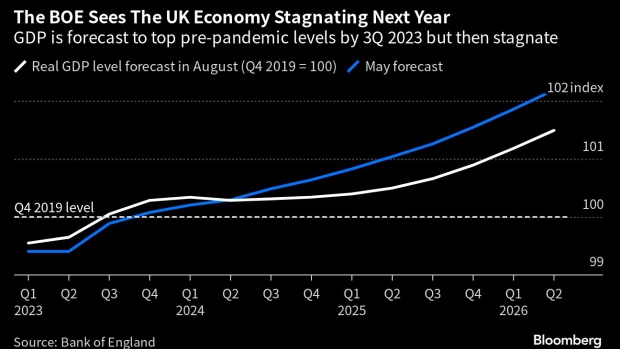

The UK currency has been on a downward trend since reaching the highest in over a year in mid-July and extended those losses this week after the BOE raised rates by a quarter point. The decision, along with signs the economy is on a shaky footing, led traders who once bet the key rate would climb past 6.5% to see it reaching 5.75%.

It all makes the pound much less compelling to investors who seek out currencies that offer a high carry — or the gain obtained from differing interest rates — as well as strong economic growth. UK housing prices are falling fast and a gauge of manufacturing data is at recessionary levels.

“Sterling investors will start to price in an increasingly gloomy economic outlook,” said Luca Paolini, chief strategist at Pictet Asset Management. “Economic surprises have become increasingly less positive and run the risk of being outright disappointing in the coming months.”

Pictet AM downgraded the pound to underweight from neutral last week, citing a gloomy outlook for the UK economy.

The BOE has delivered 14 rate hikes since late 2021, taking the key rate from 0.1% to 5.25% last week after a 25-basis point hike. Voting for the latest move was far from unanimous, with monetary policy council members defending a hold, as well as a quarter-point and a half-point hike.

“I do not think we will get more than one” hike, said Lee Ferridge, a strategist at State Street. “And depending on the data over the next two months, we may not even get that one.”

Read more: BOE’s Final Steps to Plateau Will Maintain Volatility to the End

An earlier-than-expected pause from the BOE would jolt rates markets, with short-term bond yields falling to account for the new peak rate — and possibly taking the pound with them.

Ferridge sees sterling falling below $1.20 over the next two to three months from $1.27 on Friday and recommends a short position against the yen and the US and Canadian dollars.

Swaps tied to the central bank’s meetings imply borrowing costs peaking at 5.75% by early next year, meaning two quarter-point hikes are fully priced and there’s some chance of a third, final move.

BOE Governor Andrew Bailey’s promise to keep rates elevated for longer is unlikely to put a floor under the pound’s slide. At Thursday’s press conference, Bailey said the “last mile” of the inflation fight will require a prolonged period of restrictive interest rates. Some analysts argue that may not reassure if economic data continues to disappoint.

“Ultimately we see the risk of economic damage as greater than the reward of an interest rate hike,” said Helen Given, an FX spot trader at Monex USA.

While Britain’s economy avoided a recession that many including the BOE had predicted for this year, recent data suggest the fallout from the sharpest rate rises in three decades is intensifying. A Nationwide Building Society survey showed house prices falling at their fastest pace since the global financial crisis for a third straight month, while British companies reported their slowest growth in six months.

Read more: UK’s War on Inflation Is Hitting Families and Renters Hardest

“Higher rates might not provide the best support, given the tradeoffs between growth, inflation, and domestic housing markets,” said Mark McCormick, head of FX and EM strategy at Toronto Dominion Bank. “Markets are likely to reward currencies with greater growth momentum.”

--With assistance from Alice Gledhill and Anchalee Worrachate.

©2023 Bloomberg L.P.