Feb 2, 2023

Pound’s Plunge Has Egypt Poised for Another Rate Hike: Day Guide

, Bloomberg News

(Bloomberg) --

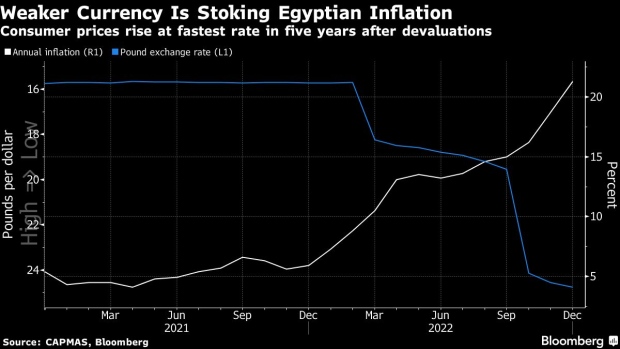

Egypt’s latest dramatic currency devaluation may leave authorities with little choice but to deliver another interest-rate hike to curb inflation that’s already running at a five-year high.

With soaring prices piling pain on consumers in the Middle East’s most populous country, seven of 10 economists surveyed by Bloomberg predict the central bank will raise interest rates for the fifth time in less than a year on Thursday, in forecasts ranging from one to two percentage points. The other three expect the benchmark deposit rate to stay at 16.25%.

“The battle against inflation is still in its early stages,” said Mohamed Abdelmeguid, Middle East and North Africa economist at BNP Paribas. A hike in local fuel prices is widely expected soon and would add more pressures.

The regulator raised rates by a combined 800 basis points in 2022, and recently scrapped subsidized lending to some sectors.

Annual consumer prices increased 21.3% in December, fueled by a 37.2% rise in food and beverage costs. The central bank is targeting inflation at an average of 7%, plus or minus 2 percentage points, by the fourth quarter of 2024.

Read: IMF Says Egypt on Path for Flexible Currency But Challenges Loom

The pound, which has lost almost half of its value against the US dollar since March, plunged 18% last month alone after authorities opted to allow greater flexibility in the exchange rate to secure a $3 billion deal with the International Monetary Fund. The devaluation will likely spur inflation to even greater heights.

The North African nation of more than 100 million people has been heavily exposed to the shock waves of Russia’s invasion of Ukraine and is struggling with its worst foreign-currency crunch in years.

The pound weakened Monday past 30 against the dollar for the first time in more than two weeks.

Further monetary policy tightening could “offer the currency support”, said Simon Williams, chief economist at HSBC Holdings Plc for Central & Eastern Europe, the Middle East and Africa, and would also help the pound settle around the mid-point of the 30-35 range over the rest of the fiscal year, which ends in June.

Many traders in the foreign-currency black market, which emerged as Egyptians struggled to find dollars through official channels, are pausing operations pending the Monetary Policy Committee’s decision and any further movement in the official currency rate.

The central bank may also need to hike rates to “stimulate further portfolio inflows as it continues its efforts to clear the FX backlog and transition to a more flexible exchange-rate regime,” said Farouk Soussa, an economist at Goldman Sachs Group Inc.

Read: Record Yield Spread on Egypt’s Local Debt Coaxes Back Investors

--With assistance from Netty Ismail and Harumi Ichikura.

©2023 Bloomberg L.P.