Jun 28, 2022

Procter & Gamble Worker Shortage Puts a Third of US Tampon Market at Risk

, Bloomberg News

(Bloomberg) -- For the latest example of just how tight US labor markets are, look to consumer-goods giant Procter & Gamble Co. In its bid to lure workers to one of the country’s most important tampon plants, the company has been raising wages for months.

Ahead of a February 2021 job fair, the company advertised a starting hourly rate of $17.91 at the plant in Auburn, Maine. That was up to $23.41 in July. And by January, it hit $25.41, topping the national average for manufacturing workers by almost 50 cents. The advertised average annual wage has gone from $47,000 to $57,00 to $60,800 -- with “opportunity to grow.” Highlighted benefits include 15 paid vacation days, 12 paid holidays, health insurance and a free fitness center.

It’s still not enough.

P&G says that staffing at the Auburn plant -- the sole source of its Tampax-brand tampons sold in the US -- has “largely stabilized,” but people familiar with the production needs say that the facility is short-handed.

Staffing problems have coincided with an increase in tampon demand. The issues haven’t led to a full-on shortage, but some women across the country started to stock up as reports of lower inventories spread. Supply chains have also been strained by raw material costs. Still, on-shelf availability has improved in recent weeks, according to market research firm IRI.

What’s happening at P&G’s tampon plant is emblematic of the wider squeeze felt by employers across the country, from restaurants to oil drillers. With nearly two open jobs per every unemployed worker, the increased competition has driven up wages and added to inflation pressures, prompting Federal Reserve Chair Jerome Powell to recently dub the labor market “unsustainably hot.” Labor force participation may never fully bounce back to its pre-pandemic strength, something that could make filling positions an ongoing challenge in the years ahead.

P&G says it has taken multiple steps to ensure supply of tampons.

“Over the past few years, while we have experienced periods of turnover in our staff -- consistent with industry trends -- today our workforce in Auburn has largely stabilized, which is one reason we’re able to expand for additional tampon manufacturing capacity,” P&G said in an emailed statement.

“This expansion complements work already underway, including previously announced warehouse and direct-ship capacity, as well as maximizing current equipment and scaled-up staffing to produce record levels of tampons per day.”

Why the Maine Plant Matters

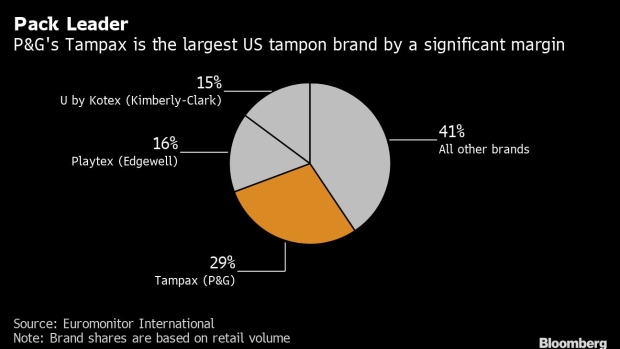

Tampax is by far America’s No. 1 tampon brand, with control of nearly a third of the market in 2021, according to Euromonitor International. And the plant in Maine is the only one where P&G makes the products in North America.

P&G got control of the Tampax brand after its acquisition of White Plains, New York-based Tambrands in the late 1990s. The plant, which employs about 400, is in one of the country’s least-populous states, partly because the location gave it easier access to timber supplies. Tampons often use tree-derived cellulose fibers for absorbency and cardboard for packaging.

Menstrual-Care Inflation

Higher labor costs, along with other rising expenses for P&G and rivals like Edgewell Personal Care Co., has translated into inflation for period products. Average prices rose 8.3% for a package of menstrual pads and 9.8% for tampons in the year through May 28, according to NielsenIQ.

Read more: ‘Period poverty’ is getting worse

Meanwhile, Instacart has said it’s spotted an increase in stock-up behavior as news of lower supply availability spreads. Tampon sales on the online grocery platform rose 50% between June 13 and June 15.

The result ends up being more hardship for shoppers, particularly those on the lower end of the income scale. And it’s another pandemic blow to women, who are already dealing with disproportionate impact from the child-care crisis and the baby-formula shortage.

This month, P&G’s careers website featured job postings in Auburn for a plant technician and an electrical engineer, among others.

The company has been able to attract talent, but turnover for new hires is high, people familiar said. An intense schedule could be part of what turns new workers off.

Employees at the facility alternate between night and day 12-hour shifts every couple of days. The plant operates 24 hours a day, seven days a week. And making tampons carries an extra layer of stress, since the US Food and Drug Administration regulates them as medical devices.

Even with those burdens, it wasn’t until the broader labor shift that the plant began having trouble finding workers.

©2022 Bloomberg L.P.