Jul 12, 2021

PTT Global Buys European Chemicals Maker for $4.75 Billion

, Bloomberg News

(Bloomberg) -- Thailand’s PTT Global Chemical Pcl will acquire Allnex Holding GmbH, a European specialty chemicals maker, for 4 billion euros ($4.75 billion) to scale up its presence in the high-value chemicals products. PTT Global’s shares slumped the most in more than a year.

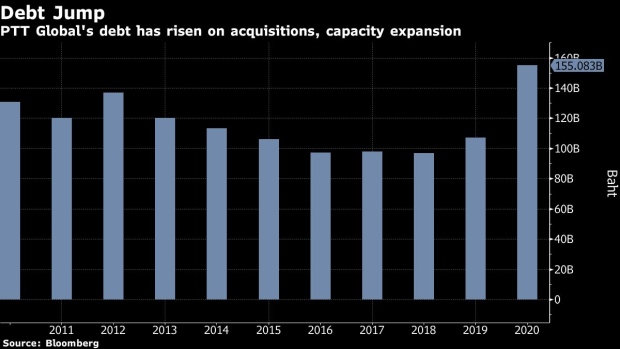

PTT Global will acquire 100% common stocks of Allnex Holding for 132.6 billion baht, or 3.58 billion euros, and also assume 426 million euros of loans, it said in an exchange filing on Monday. The company will finance the acquisition through own cash and with support from its parent PTT Pcl, it said.

“PTT Global has so much excess cash that would help fund their aggressive expansion and acquisitions,” said Naphat Chantaraserekul, an analyst at Krungsri Securities Co. “The acquisition cost looks high from our review of Allnex’s recent earnings.”

PTT Global tumbled as much as 7.3% to 54.25 baht in Bangkok trading, the biggest intraday decline since June 2020. Shares of PTT, Thailand’s biggest company by market value, rose 0.7% to 37.50 baht by 11:37 a.m. local time.

PTT Global and its main local rivals -- Indorama Ventures Pcl and Siam Cement Pcl -- have stepped up overseas acquisitions and investments in recent years to expand their production of chemical materials used for plastic packaging, bottles and other products. PTT Global’s Allnex purchase will be the biggest overseas acquisition by a Thai company since Thai Beverage Pcl’s takeover of Fraser and Neave Ltd. in 2012, according to data compiled by Bloomberg.

Searching Profit

Global refiners have been making inroads into the plastic and specialty chemical sectors in search of better profit margins. With the rising electrification of cars and a slowdown in oil-demand growth, more fuel producers across China and India are also turning their focus to petrochemicals rather than gasoline and diesel.

See also: Global Oil Refining Faces Shake-Up From Asian Plastics Boom

Petrochemicals are set to be the biggest source of oil-demand growth over the medium-term, overshadowing an increase in transport fuels consumption, according to the International Energy Agency. Demand for raw materials used to make petrochemicals -- namely ethane, liquefied petroleum gas and naphtha -- is expected to expand through 2026, it wrote in a report.

PTT Global expects to complete the transaction in December. The company signed a agreement with PTT, the state-controlled energy giant, for as much as 73.9 billion baht of loans to fund its investment in high-value business, it said in a separate statement. The 2-year loan will have an interest rate of as much as 2.5% a year, it said.

(Updates share price in fourth paragraph.)

©2021 Bloomberg L.P.