Dec 15, 2022

Quants May Be Forced to Sell $30 Billion of Stock Futures as Markets Drop

, Bloomberg News

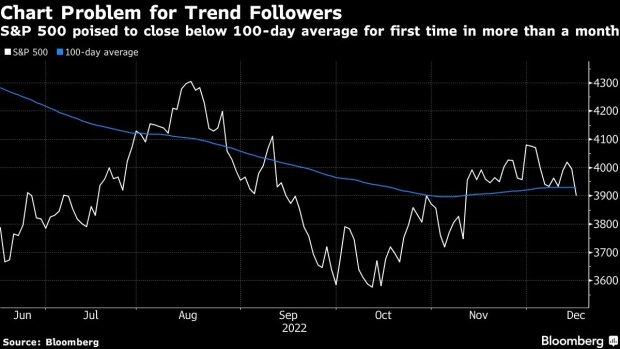

(Bloomberg) -- Thursday’s stock selloff sent the S&P 500 to levels that likely made bears of certain types of rules-based investors.

Commodity trading advisers, who place macro bets in the futures market, likely turned sellers as the S&P 500 dropped as much as 2.6% to 3,892, according to Nomura Securities International’s cross-asset strategist Charlie McElligott. The big money managers could be forced to drop their heretofore bullish posture and go as much as 83% short should the benchmark index close below 3,933, his model shows.

In a scenario where major stock benchmarks tumble 2%, these systemic funds may need to unload $30 billion of global stock futures, with roughly $11 billion coming from contracts linked to the S&P 500, McElligott estimates.

“This fade in spot has us nearing some rather substantial potential ‘sell/delever’ triggers,” the strategist wrote in a note to clients.

Stocks fell for a second session amid a wave of monetary tightening from central banks worldwide. The European Central Bank hiked interest rates one day after the Federal Reserve, with both warning of more pain to come.

The S&P 500 is at risk of closing below its 100-day moving average for the first time in a more than a month. The trendline, sitting near 3,931, had provided support twice in December.

©2022 Bloomberg L.P.