Sep 25, 2023

Raft of Commercial Mortgage Bond Ratings Were Slashed, Bank of America Says

, Bloomberg News

(Bloomberg) -- Credit ratings were cut on the highest number of commercial mortgage-backed securities in “recent memory” last week, according to strategists at Bank of America Corp.

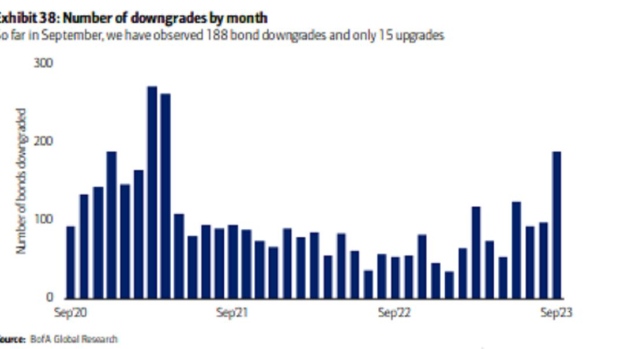

The tally of downgrades last week hit 121 tranches from 40 deals, according to the bank. Many were tied to Fitch Ratings’ ongoing review of the CMBS bond market as the ratings company downgraded or warned of underperforming offices, retail locations and hospitality properties or portfolios. So far in September, BofA has spotted 188 bond downgrades and just 15 upgrades.

The CMBS sector could also be pressured by the National Association of Insurance Commissioners (NAIC) annual risk-based capital review, according to BofA. The consortium of state regulators sets standards for the insurance industry, influencing what some insurance companies buy.

“Although in practice many insurers manage to multiples of their RBC requirements, CMBS bondholders across investor types still regard changes in NAIC designation categories with caution,” BofA strategists Alan Todd and Henry Brooks wrote in a Sept. 22 client note. The designations “can potentially result in insurance company selling in the event the re-classification results in too significant of a required increase.”

Further, the increase in pace and severity of bond downgrades may cause this year’s review to be somewhat more punitive than last, according to Todd and Brooks. Investors should remain up-in-credit for the time being and should take a “judicious approach” to due diligence on any mezzanine credit.

©2023 Bloomberg L.P.